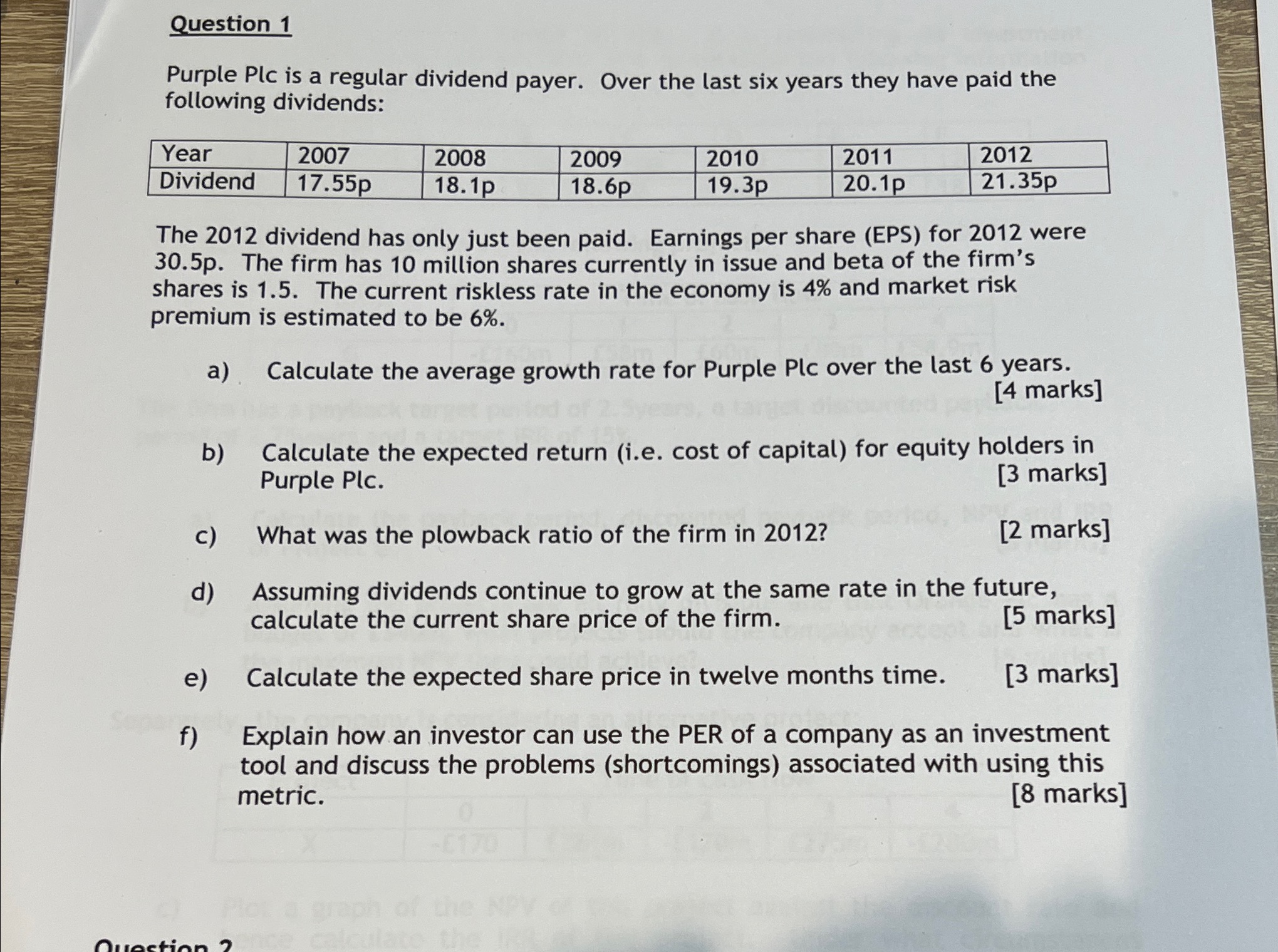

Question 1Purple Plc is a regular dividend payer.Over the last six years they have paid thefollowing dividends:Year200720082009201020112012Dividend17.55p18.1p18.6p19.3p20.1p21.35pThe 2012 dividend has only just been paid.Earnings per share (EPS)for 2012 were30.5p.The firm has 10 million shares currently in issue and beta of the firm'sshares is 1.5.The current riskless rate in the economy is 4%and market riskpremium is estimated to be 6%.a)Calculate the average growth rate for Purple Plc over the last 6 years.[4 marks]b)Calculate the expected return (i.e.cost of capital)for equity holders inPurple Plc.[3 marks]c)What was the plowback ratio of the firm in 2012?[2 marks]d)Assuming dividends continue to grow at the same rate in the future,calculate the current share price of the firm.[5 marks]e)Calculate the expected share price in twelve months time.[3 marks]f)Explain how an investor can use the PER of a company as an investmenttool and discuss the problems (shortcomings)associated with using thismetric.[8 marks]

没有找到相关结果