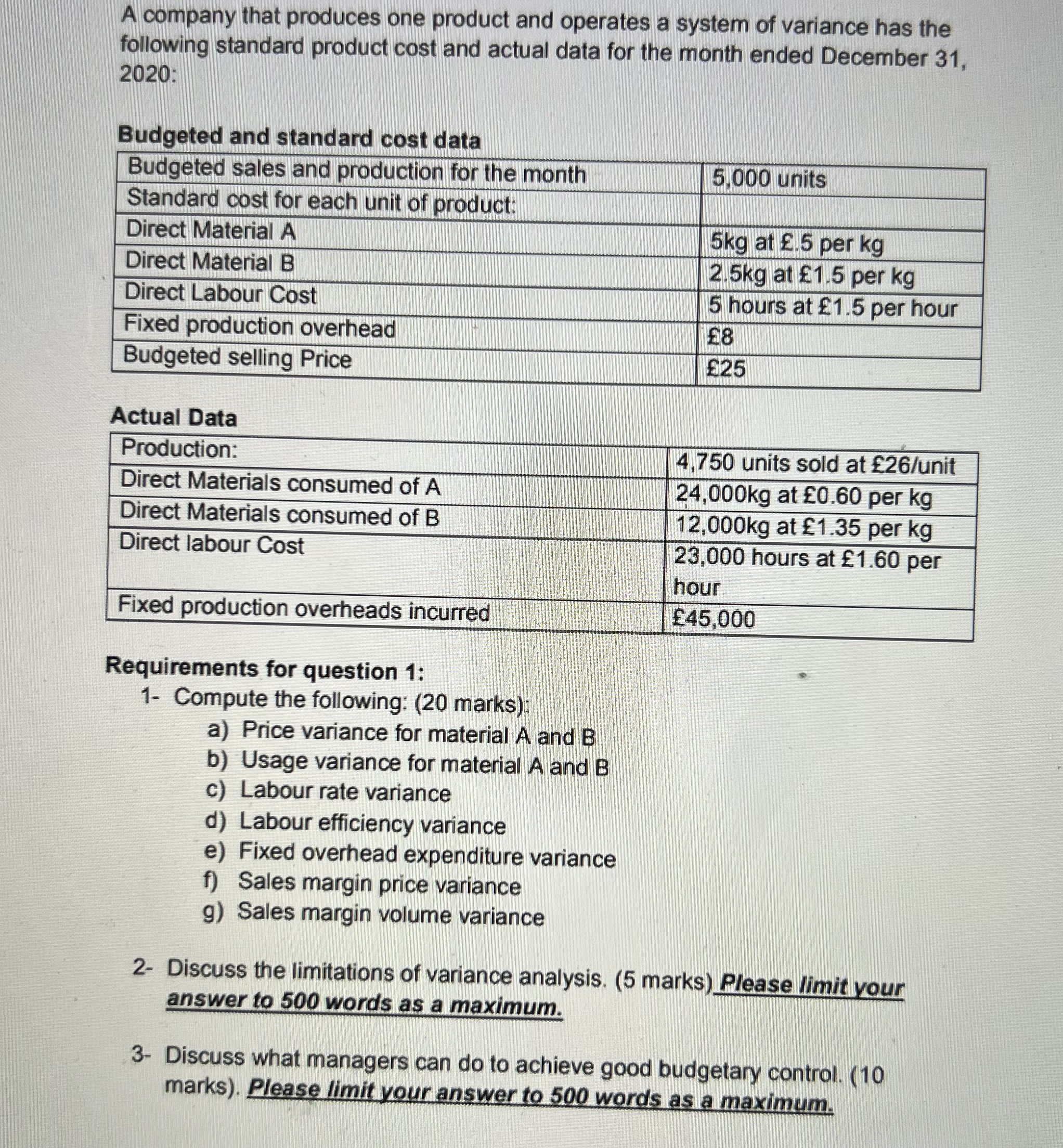

A company that produces one product and operates a system of variance has thefollowing standard product cost and actual data for the month ended December 31,2020:Budgeted and standard cost dataBudgeted sales and production for the month5,000 unitsStandard cost for each unit of product:Direct Material A5kgat£.5 per kgDirect Material B2.5kg at E1.5 per kgDirect Labour Cost5 hours at£1.5 per hourFixed production overheadE8Budgeted selling Price25Actual DataProduction:4,750 units sold at£26/unitDirect Materials consumed of A24,000kgat£0.60 per kgDirect Materials consumed of BDirect labour Cost12.000kgat£1.35 per kg23,000 hours at£1.60perhourFixed production overheads incurred£45.000Requirements for question 1:1-Compute the following:(20 marks):a)Price variance for material A and Bb)Usage variance for material A and Bc)Labour rate varianced)Labour efficiency variancee)Fixed overhead expenditure variancef)Sales margin price varianceg)Sales margin volume variance2-Discuss the limitations of variance analysis.(5 marks)Please limit youranswer to 500 words as a maximum.3-Discuss what managers can do to achieve good budgetary control.(10marks).Please limit your answer to 500 words as a maximum.

没有找到相关结果