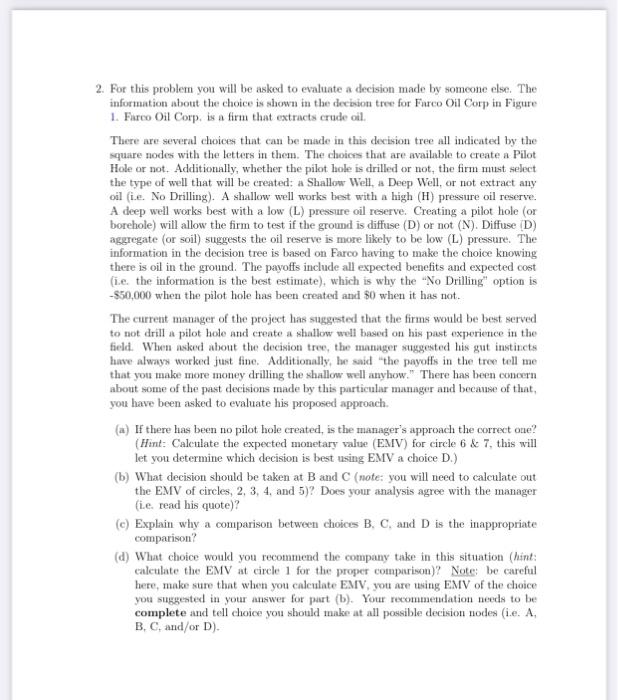

2. For this problem you will be asked to evaluate a decision made by someone else. The information about the choice is shown in the decision tree for Furco Oil Corp in Figure 1. Furco Oil Corp, is a firm that extracts crude oil. There are several choices that can be made in this decision tree all indicated by the square nodes with the letters in them. The choices that are available to create a Pilot Hole or not. Additionally, whether the pilot hole is drilled or not, the firm must select the type of well that will be created: a Shallow Well, Deep Well, or not extract any oil (i.e. No Drilling). A shallow well works best with a high (H) pressure oil reserve. A deep well works best with a low (L) pressure oil reserve. Creating a pilot hole (or borehole) will allow the firm to test if the ground is diffuse (D) or not (N). Diffuse (D) aggregate (or soil) suggests the oil reserve is more likely to be low (L) pressure. The information in the decision tree is based on Farco having to make the choice knowing there is oil in the ground. The payoffs include all expected benefits and expected cost (i.e. the information is the best estimate), which is why the "No Drilling" option is -$50,000 when the pilot hole has been created and 80 when it has not. The current manager of the project has suggested that the firms would be best served to not drill a pilot hole and create a shallow well based on his past experience in the field. When asked about the decision tree, the manager suggested his gut instincts have always worlond just fine. Additionally, he said "the payoffs in the tree tell me that you make more money drilling the shallow well anyhow." There has been concern about some of the past decisions made by this particular manager and because of that you have been asked to evaluate his proposed approach. (a) If there has been no pilot hole created, is the manager's approach the correct one? (Hint: Calculate the expected monetary value (EMV) for circle 6 & 7, this will let you determine which decision is best using EMV a choice D.) (b) What decision should be taken at B and C (note: you will need to calculate out the EMV of circles, 2, 3, 4, and 5)? Does your analysis agree with the manager (i.e read his quote)? (c) Explain why a comparison between choices B. C. and D is the inappropriate comparison? (d) What choice would you recommend the company take in this situation (hint: calculate the EMV t circle 1 for the proper comparison? Note be careful here, make sure that when you calculate EMV, you are using EMV of the choice you suggested in your answer for part (b). Your recommendation needs to be complete and tell choice you should make at all possible decision nodes (ie. A B, C, and/or D). PLN) 5145.000 Figure 1: Faeco Oil Corp.'s Decision Tree Ne Drilling PHD) - $350.000 PLD)-09 $145,000 PN) 070-5150.000 -S50.00 $275,000 B В Shallow Well -$160,000 550.000 $275,000 Slulow. Well 3160,000 PHD) H PLD Deep Well PID)- 15 PIN) 0.55 EN i Hole CSSR No Dilling PWN) 0.75 PILN) - 0 Deep Well No Plus No Drilling $325.000 PH) 0.5 D Shallow Well PL) 0.5 Deep Well -$110,000 PH) 05 H PL) 0.5 $195.000

没有找到相关结果