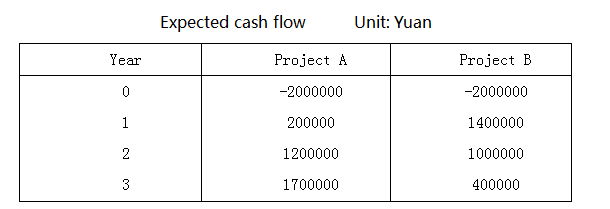

Suppose there are two investment projects with the same risk characteristics, a 10% cost of capital, and the respective cash flows shown in the following table. Requirements:

(1) Calculate the net present value of the two projects.

(2) Calculate the payback period of the two projects.

(3) Calculate the embedded rate of return of the two items.

(4) Calculate the present value index of the two projects.

(5) According to the above calculation, if the two projects are independent, how should the enterprise choose? If mutually exclusive, how to choose.

没有找到相关结果