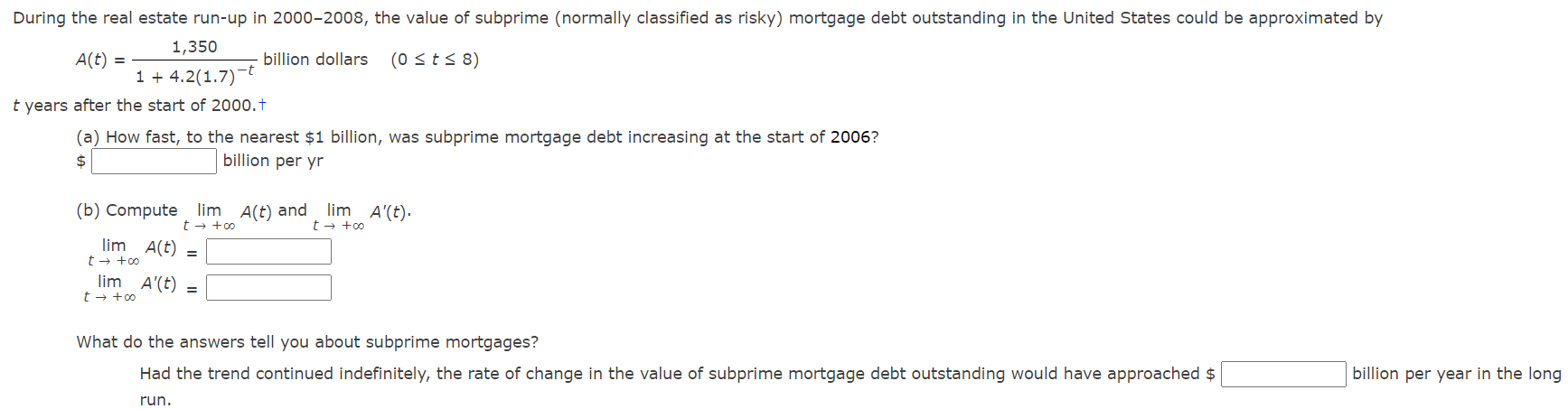

During the real estate run-up in 2000-2008, the value of subprime (normally classified as risky) mortgage debt outstanding in the United States could be approximated by 1,350 A(t): billion dollars (Osts 8) 1 + 4.2(1.7) t years after the start of 2000. + = (a) How fast, to the nearest $1 billion, was subprime mortgage debt increasing at the start of 2006? billion per yr $ (b) Compute lim A(t) and lim A'(t) t → +00 t + +00 lim Alt) t + +00 lim A'(t) t → +00 What do the answers tell you about subprime mortgages? Had the trend continued indefinitely, the rate of change in the value of subprime mortgage debt outstanding would have approached $ billion per year in the long run.

没有找到相关结果