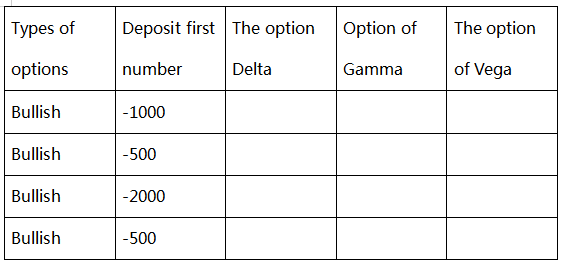

A financial institution holds the following OTC options trading portfolios with the underlying assets in GBP:

The Delta of an exchange-traded option is, Gamma is, and Vega is:

(1) How many exchange options can be used to make the OTC trade both Gamma and Delta neutral? In this case, whether the trade is a long position or a short position.

(2) What and how many exchange options can be used to make the OTC portfolio both Gamma and Delta neutral.

没有找到相关结果