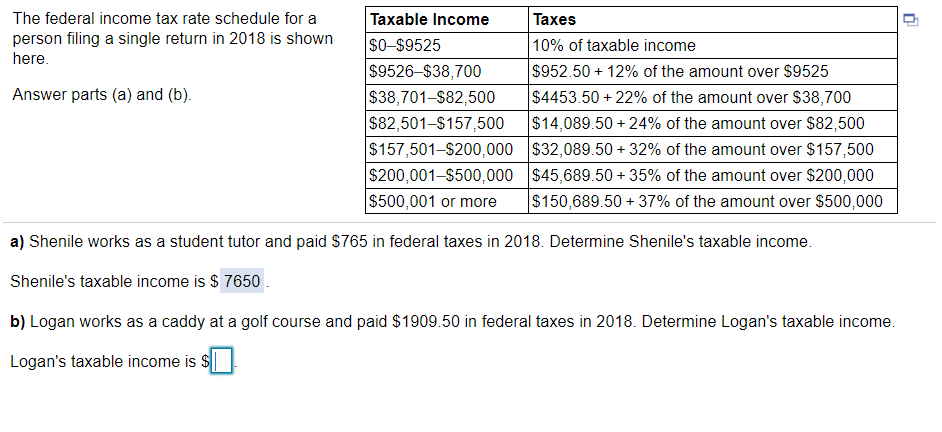

The federal income tax rate schedule for a person filing a single return in 2018 is shown here. Answer parts (a) and (b). Taxable income Taxes $0-$9525 10% of taxable income $9526-$38,700 $952.50 +12% of the amount over $9525 $38,701-$82,500 $4453.50 + 22% of the amount over $38,700 $82,501-S157,500 $14,089.50 +24% of the amount over $82,500 $157,501-$200,000 $32,089.50 +32% of the amount over $157,500 $200,001-$500,000 $45,689.50 + 35% of the amount over $200,000 $500,001 or more $150,689.50 +37% of the amount over $500,000 a) Shenile works as a student tutor and paid $765 in federal taxes in 2018. Determine Shenile's taxable income. Shenile's taxable income is $ 7650 b) Logan works as a caddy at a golf course and paid $1909.50 in federal taxes in 2018. Determine Logan's taxable income. Logan's taxable income is $||

没有找到相关结果