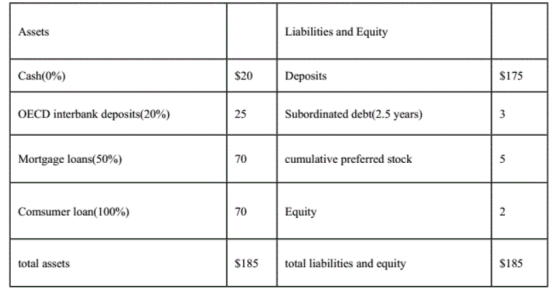

Third bank has following balance sheet (in millions) with the risk weights in parentheses.

In addition, the bank has $30m in performance-related standby letters of credit, $40m in two-yearforward FX contracts that are currently in the money by $1m, and S300m in six-year interest rateswaps that are currently out of the money by 2m,and credit conversion factors follows:

1. performance-related standby LC, 50%.

2.1-5 year foreign exchange contracts,5%3. 5-10 year interest rate swaps,1.5%

(1). What are the risk-adjusted on balance-sheet assets of the bank as defined under the Basel Accord.

(2). What is the total capital required for both off- and on-balance-sheet assets?

没有找到相关结果