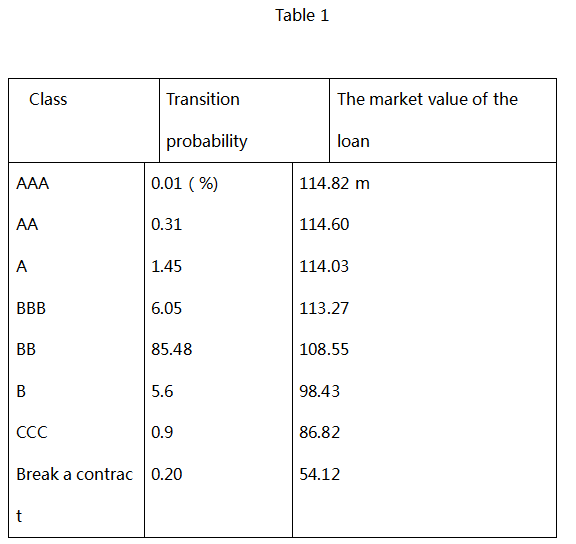

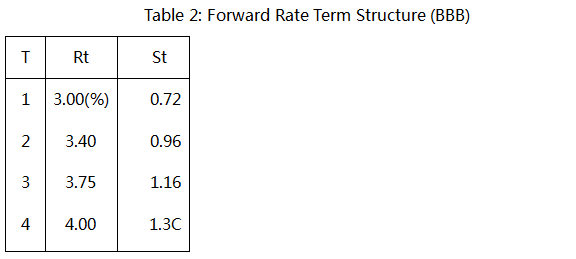

A five-year fixed interest rate loan with an amount of 1 million, an annual coupon rate of 7%, and a borrower's credit rating of BB. According to the assumed data, the probability of the borrower's credit rating being converted in the next year is shown in Table 1. Meanwhile, the term structure of forward interest rate of BBB rated bonds in the bond market is shown in Table 2.

(1). At the end of the next year, calculate the market value of the loan when the borrower's credit rating is converted from BB to BBB.

(2)At the end of the next year, the expected value of the loan is calculated.

(3). At the end of the next year, calculate the volatility in the value of the loan.

(4). Assuming that the loan value obeys normal distribution, calculate VaR of 5% and 1%.

(5). Calculate the VaR of 5% and 1% for the actual distribution of loan value.

没有找到相关结果