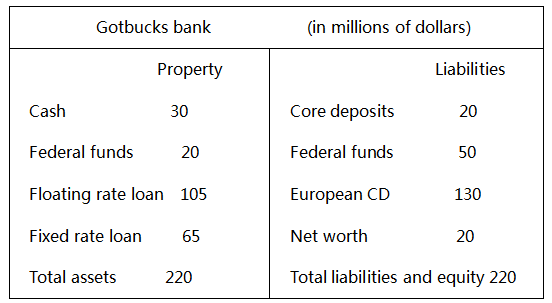

Answer questions A to E using the data provided about Gotbuks Bank Inc. (GBI) :

Note: The current federal funds rate is 8.5%. Variable rate loans are priced at LIBOR (currently 11%) plus 4% fixed rate loans for five years at 12%, which pay interest once a year. Core deposits are all paid at a two-year fixed rate of 8 per cent and are paid once a year. The current yield on European CDs is 9%.

(1) How long will the GBI fixed rate portfolio be valid if the loan is priced at market rates?

(2). If the average time to re-price the GBI's floating rate (including federally funded assets) is 0.36 years, what is the validity of the bank's assets? (Note that cash is valid at zero)

(3). How long is the GBI's core deposit valid if it is priced at a coupon rate?

(4). If the average time for the repricing of the GBI's European CD and federal funding liabilities is 0.401 years, what is the validity of the bank liabilities

(5). What is the validity gap of GBI? What is the bank's interest rate exposure? If all yields rise by 1%, what is the effect on the market value of the net GBI value? AR/(1+R) for all assets and liabilities.

没有找到相关结果