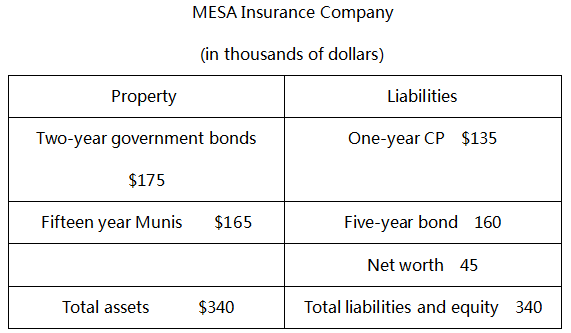

Consider the balance sheet of one of the following financial institutions:

Note: All securities are sold at book value. Two-year Treasury bills are at 5%, 15-year MUNIS is at 9%, 1-year commercial paper (CP) pays 4.5% and five-year bonds are at 8%. Let's say all the notes are paid once a year.

(1). What is the weighted average maturity of the financial institution's assets?

(2). What is the weighted average maturity of its liabilities?

(3). What is the maturity gap? What does it mean for its interest rate risk?

没有找到相关结果