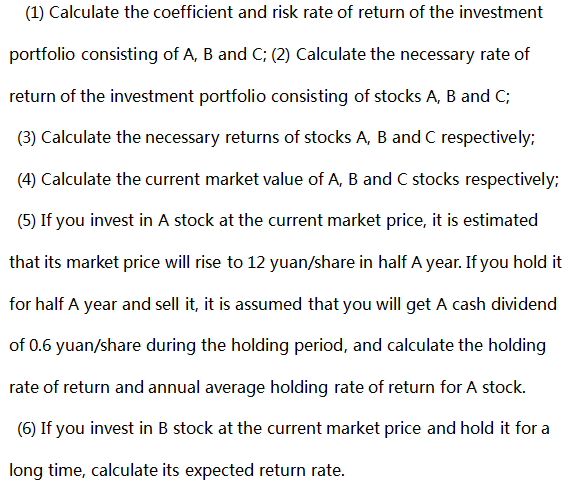

Company A intends to invest and purchase three stocks A, B and C to form A portfolio. The current market prices of these three stocks are 8 yuan/share, 10 yuan/share and 12 yuan/share respectively, and the β coefficient is 1.2, 1.9 and 2 respectively, accounting for 20%, 45% and 35% of the investment in the portfolio respectively. The current dividend is 0.4 yuan/share, 0.6 yuan/share and 0.7 yuan/share respectively. A stock is A fixed dividend stock, while B stock is A fixed growth stock with A fixed dividend growth rate of 5%. The dividend growth rate of C stock is 18% in the first 2 years and 6% in the next 2 years. Assume that the average return on the stock market is currently 16% and the risk-free return is 4%.

没有找到相关结果