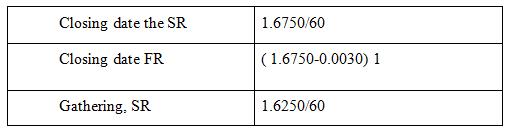

An American merchant exported goods to England. The payment of one million pounds would not be received for three months. To avoid a fall in the exchange rate of the pound after three months, the American exporter decided to make a three month forward foreign exchange deal. Suppose the spot rate of GBP/USD in New York is 1.6750/60 at the time of transaction, and the three-month forward spread of GBP is 30/20. If the spot rate of GBP/USD is 1.6250/60 on the day of receipt, what is the difference between a US exporter doing a forward trade and not doing a forward trade?

(Excluding transaction costs)

没有找到相关结果