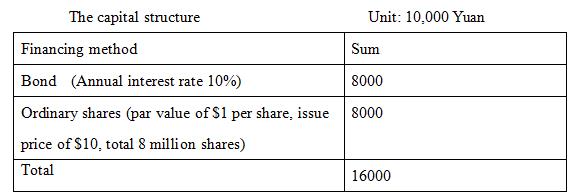

The original capital structure of a company is shown in the following table. The par value of common stock is RMB yuan per share, and the issue price is RMB 10. The current price is also RMB 10. The expected dividend this year is RMB 1 / share, and it is expected to increase the dividend by 5% every year in the future. The enterprise applies the income tax rate of 33%, assuming that the various securities issued have no financing fees.

The enterprise now plans to increase capital by 40 million yuan to expand the scale of production and operation. There are three options as follows:

Plan A: increase the issuance of 40 million yuan of bonds, due to the increase of liabilities, investors increase risk, bond interest rate increased to 12% can be issued, expected common stock dividend unchanged, but due to the increase in risk, the common stock market price will be reduced by 8 yuan/share.

Plan B: issuance of bonds 20 million yuan, the annual interest rate is 10%, issuance of 2 million shares, the issue price of 10 yuan per share, expected common stock dividend unchanged. Plan C: issue 4 million shares, the market price of ordinary shares is 10 yuan per share.

Calculate their weighted average cost of capital separately and determine which option is best.

没有找到相关结果