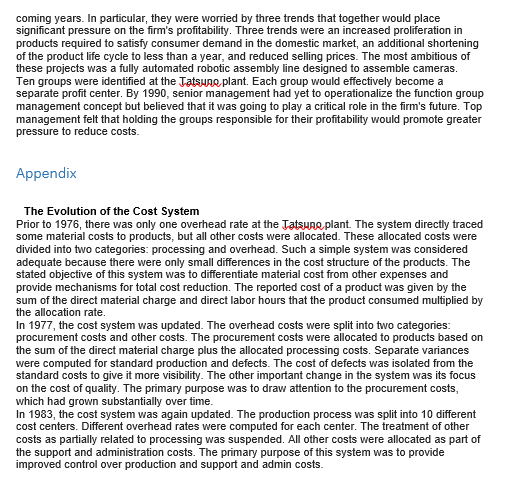

Olympus Optical Company, Ltd. (A): Cost Management for Short Life-Cycle Products Introduction Olympus was founded in 1919 as Takachiho Seisakusho, a producer of microscopes. The first Olympus camera was developed in 1938. and by 1990 Olympus was the world's fourth-largest camera manufacturer. In 1995, the consumer products division employed 3.900 people (29% of the total Olympus work force) and generated revenues of #73 billion. Cameras were by far the firm's most important consumer product, accounting for 62.8 billion in revenues. The firm's major product lines included cameras, video camcorders, microscopes, endoscopes, and clinical analyzers, and microcassette tape recorders. The brand name Olympus was first used in 1921 and became the Firm's name in 1949. The consumer products department had six departments: division planning, quality assurance, marketing, product development, production and overseas manufacturing. Tatsung, was responsible for trial production of experimental products, introductory production of new products, and, to a limited degree, camera and lens production. Five other domestic manufacturing facilities reported to Tatsuno. These facilities were all located in Japan and were responsible for plastic molded parts, lenses, camera assembly, and die casting. Overseas production facilities located in Hong Kong and China reported to the overseas manufacturing department. for plastic molded parts, lenses, camera assembly, and die casting. Overseas production facilities located in Hong Kong and China reported to the overseas manufacturing department. The 35mm Camera Market Canon and Minolta were the largest of the five fimms, each with approximately 17% of the market compared to Olympus' 10%. There were two major types of 35mm cameras: single lens reflex (SLR) and lens shutters (LS) or compact cameras. SLR cameras, first introduced in 1959, used a single optical path to form the images for both the film and the viewfinder, allowing the photographer to see exactly what a picture would look like before it was taken. As their price fell, they came to dominate the high-end amateur market. The low-end amateur 35mm market continued to be dominated by cameras with two separate optical paths. Compact cameras, as suggested by their name, were smaller than SLR cameras. The first compact camera, the "XA," was introduced by Olympus in 1978. The early compact cameras were relatively unsophisticated and posed little challenge to the SLR market. In the mid-1980s, the introduction of zoom auto-focus compact cameras removed the last major advantage of SLR camera. Sales ofSLR cameras plummeted when variable focal length lenses were removed in the mid-'80s. In the mid-1980s, Olympus' camera business began to lose money and by 1987 its losses were considerable. The major internal causes were poor product planning, a lack of "hit" products, and some quality problems. Externally, the appreciation of the yen from over 200 the dollar in 1985 to around 130 in 1990 was one factor. The industry had also suffered from an extended low-growth period that had caused prices to drop. Strategic Change at Olympus In 1987, Olympus' top management introduced an ambitious three-year program to "reconstruct the camera business. At the core of this program were three objectives: recapture lost market share by introducing new products. Recapturing Market Share Olympus developed a new strategy of rapidly introducing, producing, and marketing new 35mm SLR and compact cameras. The firm's strategy in the SLR market was to differentiate its products by the innovative use of technology. For compact cameras, Olympus' strategy was to develop a full line of low-cost cameras with particular emphasis on zoom lens models. One of the key elements in improving the firm's ability to react rapidly was a plan to reduce to 18 months the time required to bring new compact cameras to market. The equivalent benchmark when the OM10 SLR camera was developed in 1980 was 10 years, for example. The corporate plan identified the future mix of business by major product line. It provided division management with a charter by which to operate. The technology review had two sections. It looked at how technological developments were likely to affect the camera business. Factors included foreign exchange rates, how cameras were sold, and the role of other consumer products. Olympus was in the forefront of electronic still image capture and in 1990 had introduced its first electronic camera. In 1990, Olympus had developed an advanced electronic shutter unit that combined auto-focus control and the lens system, which allowed the size of the camera to be smaller, it says. In the 1980s, the percentage of the firm's cameras sold via specialty stores had decreased steadily from 70% to 40%. The bulk of cameras was now sold through discount houses and mass merchandisers, where profit margins were lower. Quantitative information about the world's 35mm camera market was collected from three primary sources. Olympus collected quantitative information from seven major sources. The company collected questionnaires from recent purchasers of Olympus cameras. Olympus helped pay salaries of "special salespeople who worked behind the counters at very large camera stores. These individuals supplied feedback about how their cameras were being received by consumers. The Japan Camera Industry Association provides statistics on camera industry shipments, sales by type and by overseas market. Olympus" product planning staff would spend some part of the year behind the counter selling cameras, thus becoming familiar with the reactions of both consumers and dealers. Their interviews had proven to be good predictors of future changes in the lifestyle of the Japanese population. The competitive analysis was based on any information Olympus could gather about its competitors' current and future product plans. Sources of competitive information included press and competitor announcements, patent filings, and articles in patent publications. This information was used to predict what types of products competitors would introduce in the short and long terms. Once the preliminary plan was completed, it was subjected to an exhaustive review to ensure its practicality. The product plan was accepted at a general meeting to formally accept the plan and was then implemented. Improving Product Quality Olympus' quality improvement program focused on introduction of new products and manufacturing process. Olympus cameras were historically above average in quality, but management felt that it was important to be the best. Highest quality was considered important because it would help the firm recapture its lost market share. Reducing Production Costs Olympus developed an aggressive cost-reduction program that focused on five objectives. The company aims to shift a significant percentage of production overseas. Designing High-Quality Products at Low Cost In 1995 the simplest compact cameras were sold in the U.S. at the $80 price point, down from $100 in 1991. Price point at which a camera with given functionality was sold tended to decrease over time with improvements in technology. Price points were typically held constant for as long as possible by adding functionality to the cameras offered. Olympus created a new price point of $300 when it introduced the first compact camera with 3x zoom capability in 1988. The price point for a simple compact camera was $150 in 1987 and $80 in 1995, for example, and today it is $150. The relationship between distinctive features and price points was determined from the competitive analysis and technology review used in the development of the product plan. Full-line producers were based on two strongly held beliefs: that Japanese consumers trade up over time and that only by offering a full line could a firm obtain a balanced position in the entire market. The proliferation of products due to the increase in the number of price points was further aggravated by Olympus' decision to introduce multiple models for some price points. Olympus: For high-volume price points, it was possible to identify different clusters of consumer preferences and profitably produce and market cameras designed for those clusters. In 1996, the divisional manager had identified the acceptable cost ratios as 85% for Tatsune manufactured products and 60% for products manufactured overseas. The expected market share of each camera model offered was approximately the same unless it was designed to satisfy a low-volume strategic price point, the company says. The number of models introduced at each price point was roughly proportional to the size of the market. A target cost system existed prior to 1987, but it was not considered effective. In a three-year program to reduce costs, more attention was paid to achieving the targets. The number of parts in each unit was targeted for reduction. Expensive, labor-intensive, and mechanical adjustment processes were eliminated wherever possible. Olympus sold 70% of its cameras overseas, and the FOB price of a product was the weighted average yen price. The camera range includes a digital SLR, a point-of-view camera and a digital digital digital video camera. The price of the camera will be determined by the yen-denominated target cost of production. The target cost was based on the price point for the distinctive feature of the camera. Production engineering developed estimated costs of production in collaboration with production. Research and development reviewed these estimates and revised them as deemed appropriate. The research and development group identified additional ways to reduce the cost of the product either through minor product redesign or a more efficient production process. The product design could be released for further analysis by the production group at Tatsuna 80% of the time, and the product was released to production for analysis. The production group identified ways to increase the market price or reduce the product's functionality to reduce its estimated cost to produce. In 1990, Olympus expected to reduce production costs by about 35% across the production lifetime of its products. The product was released if these life-cycle savings were sufficient to make the product's overall profitability acceptable. If the estimated costs were still too high, even with these additional cost savings included, the product was abandoned. Such strategic reasons typically focused on maintaining a full product line or creating a "flagship" product that demonstrated technological leadership. In 1990, the camera maker released a new product that it expected would be a hit with consumers, but it didn't sell well. The estimated production cost used in the evaluation of the product was the expected cost of production three months after it went into production. As the work force gained experience, production costs would fall below target costs. The cost system would report negative variances for the first three months. In subsequent months the variances were expected to be positive. Reducing Unnecessary Expenditures The program to reduce unnecessary expenditures contained four components: It analyzed fixed expenses and curtailed any unnecessary expenditures. It analyzed and improved the procedures surrounding new product launching to reduce launch costs . It lowered the cost of purchased parts by implementing strict controls to ensure that target costs were met, widening the sources of procurement to obtain lower costs, and identifying multiple suppliers for each component to create competitive pressures. It strengthened and integrated its existing cost-reduction programs Production cost control and reduction program focused on removing material, labor, and some overhead costs from products. The division's profit plan identified cost-reduction targets for these costs for each product. The standards were set every six months and included the anticipated reductions that would be achieved in the next six months. The cost of defects program consisted of setting cost-of-defect targets for each production group every 6 months. These costs were not included in the standard costs to give them high visibility, so they were not covered by the production cost control program. At Tatsune there were 10 groups responsible for segments of the production process. The company had a total of about 1,800 employees at the time of the project's completion. Cost-reduction targets were identified for each product the group produced. If the overall reductions were sufficient, management accepted the targets. The team leader and foreman in each group met daily to discuss their progress at achieving their reduction targets. A request to engineering for assistance might be included in these actions. The variance captured the over- or under-utilization of direct labor capacity at the standard distribution rate of processing costs. A capacity utilization cost budget was set every six months and updated each month, based on attendance rates, attendance rates and direct labor hours. The variance was reported to management Weekly and accumulated monthly, with a monthly average of the daily variance. Each month, the budget was compared to actual and multiple cost center variances. Costs subjected to separate variance analysis included machine repair costs, machine maintenance costs, expenses of repair and maintenance personnel. The four cost control and reduction programs each generated variances, which were combined in a monthly cost report. Improving Production Engineering Olympus achieved the desired improvements to production engineering through a three- phase approach. This approach shortened production lead times by decreasing batch sizes. The MRP system was used to check inventory levels twice a day as opposed to once a week Adopting Innovative Manufacturing Processes The program to introduce innovative production technologies focused on increasing the level of automation in manufacturing Processes included assembly, lens production, electronics parts mounting, and molding. Four major processes were automated in the three-year period after the new strategy began. All told, the program initiated some 23 different automation projects. Shifting to Overseas Production Cost reductions were further augmented by shifting some of the manufacturing processes to lower-cost areas. Cost analyses at Olympus had indicated that the potential savings from shifting production offshore was about 15%. In 1988, the firm opened production facilities in Taiwan, Hong Kong, and Korea, and in China. The New Cost-Reduction Effort The 1987 program to reconstruct Olympus' camera business achieved most of its objectives. The firm increased camera sales volume by almost 70% to ¥50 billion from #30 billion. But the SLR product line continued to lose market share from 1987 through 1990. The introduction of a completely new camera, the IS-1, the firm hoped turn situation around. But top management at Olympus determined additional cost reductions would be necessary in the coming years. In particular, they were worried by three trends that together would place significant pressure on the firm's profitability. Three trends were an increased proliferation in products required to satisfy consumer demand in the domestic market, an additional shortening of the product life cycle to less than a year, and reduced selling prices. The most ambitious of these projects was a fully automated robotic assembly line designed to assemble cameras. Ten groups were identified at the Tatsuno plant. Each group would effectively become a separate profit center. By 1990, senior management had yet to operationalize the function group management concept but believed that it was going to play a critical role in the firm's future. Top management felt that holding the groups responsible for their profitability would promote greater pressure to reduce costs. Appendix The Evolution of the Cost System Prior to 1976, there was only one overhead rate at the Tatsune plant. The system directly traced some material costs to products, but all other costs were allocated. These allocated costs were divided into two categories: processing and overhead. Such a simple system was considered adequate because there were only small differences in the cost structure of the products. The stated objective of this system was to differentiate material cost from other expenses and provide mechanisms for total cost reduction. The reported cost of a product was given by the sum of the direct material charge and direct labor hours that the product consumed multiplied by the allocation rate. In 1977, the cost system was updated. The overhead costs were split into two categories: procurement costs and other costs. The procurement costs were allocated to products based on the sum of the direct material charge plus the allocated processing costs. Separate variances were computed for standard production and defects. The cost of defects was isolated from the standard costs to give it more visibility. The other important change in the system was its focus on the cost of quality. The primary purpose was to draw attention to the procurement costs, which had grown substantially over time. In 1983, the cost system was again updated. The production process was split into 10 different cost centers. Different overhead rates were computed for each center. The treatment of other costs as partially related to processing was suspended. All other costs were allocated as part of the support and administration costs. The primary purpose of this system was to provide improved control over production and support and admin costs. Exhibit 1 Olympus Optical 1995 Financial Results | Millions of Yen Thousands of US dollars 1995 1994 1993 1995 Net sales 252,097 239,551 267, 718 2,801,078 Net income 3,101 556 3,805 34,456 Net income per share: Total assets Working capital 442,367 434,704 439,716 4,915,189 205,256 202,070 164,712 2,280,622 Shareholders' investment 182,418 183,039 145,775 2,026,287 Notes: 1. Net income per share is shown in yen and US dollars. 2. For the reader's convenience, US dollar amounts were translated from yen at the rate of 0090 = $1. 3. Fully diluted net income per share assuming full dilution is not presented because it is not significant 4. The above figures were based on accounting principles generally accepted in Japan. Assignment Questions 1. Evaluate Olympus' current strategy 2. How important are profit (P), quality (0) and functionality (F) to the industry and the firm? 3. Why did the firm shift the responsibility of product planning from R&D to marketing? 4. Evaluate the firm's decision to place multiple products in each price point. 5. Evaluate how the firm's target costing system functions. 6. What changes would you make to the firm's current target costing system and strategy? 7. How does Olympus' target costing system differ from Nissan's and Komatsu's systems? 8. How does Olympus reduce the cost of a camera? Is this process sustainable? 9. How can Olympus reduce unnecessary expenses and control production costs? 10. Describe Olympus' new cost reduction effort.

没有找到相关结果