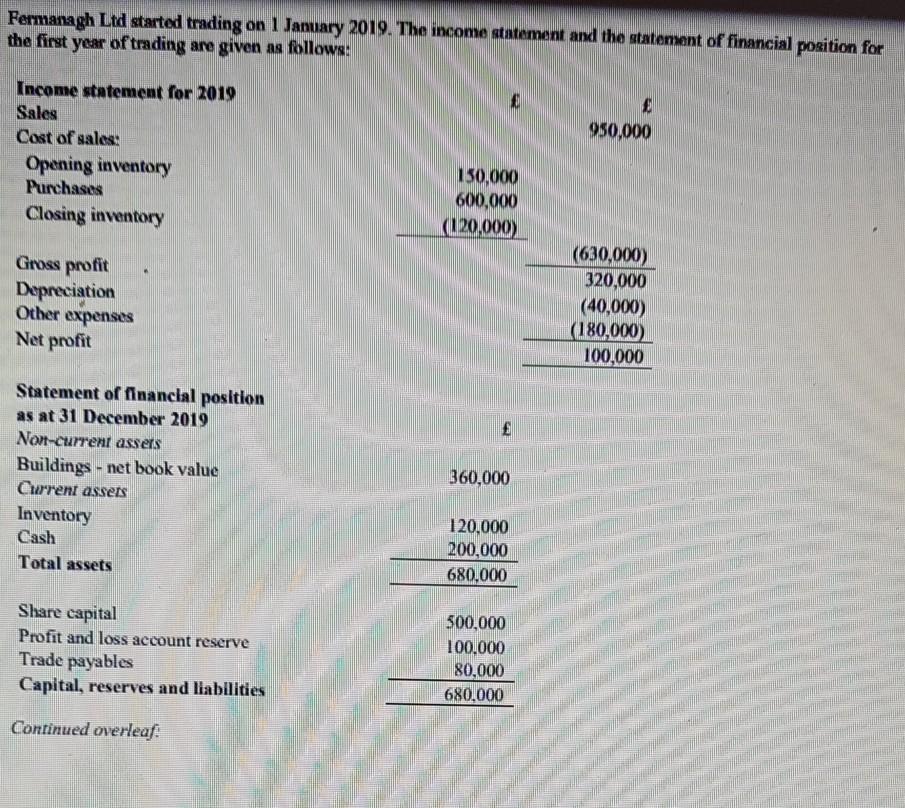

Fermanagh Ltd started trading on 1 January 2019. The income statement and the statement of financial position for the first year of trading are given as follows: 950,000 Income statement for 2019 Sales Cost of sales: Opening inventory Purchases Closing inventory 130.000 600,000 (D20,000) Gross profit Depreciation Other expenses Net profit (630,000) 320,000 (40,000) (180,000) 100,000 Statement of financial position as at 31 December 2019 Non-current assers Buildings - net book value Current assets Inventory Cash Total assets 360,000 120.000 200,000 680,000 Share capital Profit and loss account reserve Trade payables Capital, reserves and liabilities 500,000 100.000 80,000 680,000 Continued overleaf. The price change indices for the year were identified as follows: Retail price index (RPT) Inventory January 2019 Avenge for 2019 30 November 2019 31 December 2019 150 160 170 190 Non-current Assets 200 210 220 230 180 190 215 250 All non-current assets and opening inventory were acquired on the first day of trading. Closing inventory was acquired on 30 November 2019. Sales and purchases accrue evenly throughout the year. Required: a) Describe two advantages and two limitations of historical cost accounting and compare and contrast these with the advantages and limitations of replacement cost accounting. (8 marks) b) What are realised and unrealised holding gains on non-current assets within current value (replacement cost) financial statements? (2 marks) c) Prepare the current value (replacement cost) income statement for the year ended 31 December 2019 and the current value (replacement cost) statement of financial position as at 31 December 2019 for Fermanagh Ltd, using the physical operating capital maintenance basis. (10 marks)

没有找到相关结果