IF you can Answer them also by showing the calculationswith Excel sheet, would be great dear please with showing the wayof calculating and the formulas

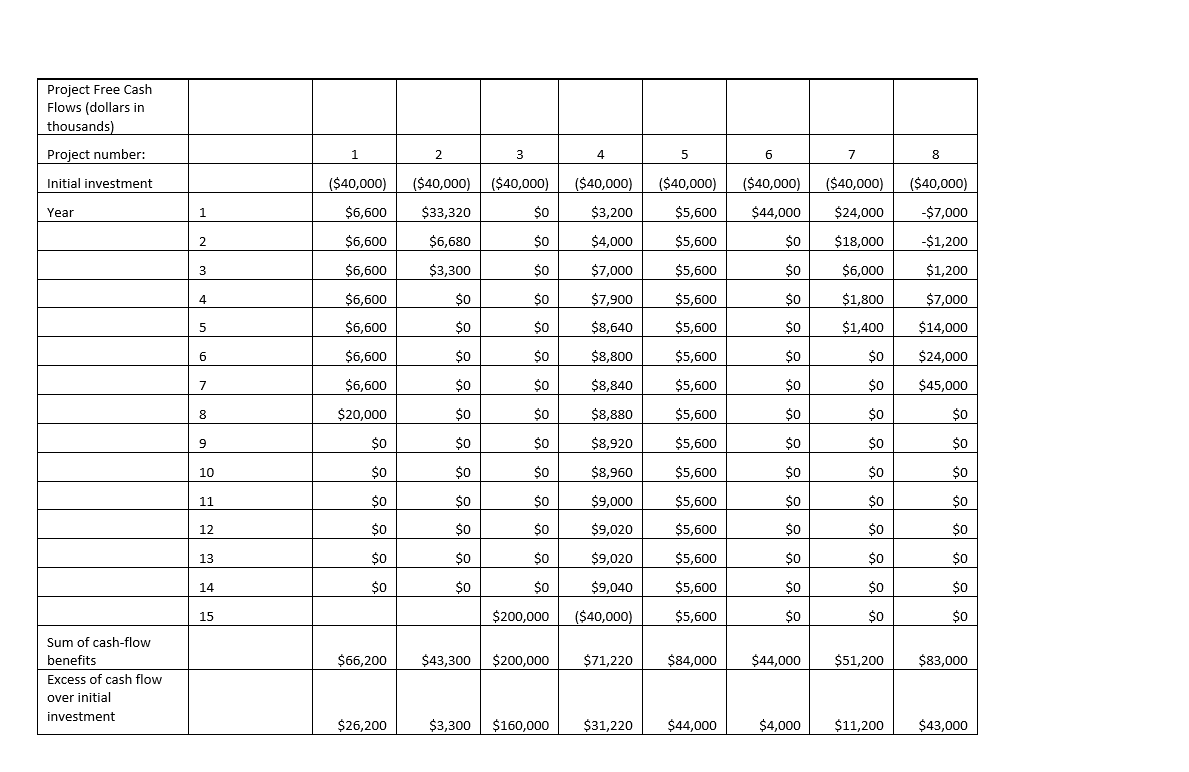

You are the capital-budgeting analyst for Dubai Holding Co.which is considering investments in the eight projects listedinthe table below.The chief financialofficer asked you to rank the projects and recommendthe“four best”that the company shouldaccept.

In this assignment, only the quantitative considerations arerelevant. No other project characteristics are deciding factors inthe selection, except that management has determinedthatprojects 3 and 4 are mutuallyexclusive.

All the projects require the same initial investment, $40million. Moreover, all are believed to be of the same risk class.The weighted-average cost of capital of the firm has never beenestimated. In the past, analysts have simply assumedthat8 percent was an appropriate discountrate.

To stimulate your analysis, consider the followingquestions:

Project Free Cash Flows (dollars in thousands) Project number: 1 2 3 4 5 6 7 8 Initial investment ($40,000) ($40,000) ($40,000) ($40,000) ($40,000) ($40,000) ($40,000) ($40,000) Year 1 $6,600 $33,320 $0 $3,200 $5,600 $44,000 $24,000 -$7,000 2 $6,600 $6,680 $0 $4,000 $5,600 $0 $18,000 $1,200 3 $6,600 $3,300 $0 $7,000 $5,600 $0 $6,000 $1,200 4 $6,600 $0 SO $7,900 $5,600 $0 $1,800 $7,000 5 $6,600 $0 $0 $8,640 $5,600 $0 $1,400 $14,000 6 $6,600 $0 $0 $8,800 $5,600 $0 $0 $24,000 7 $6,600 $0 SO $8,840 $5,600 $0 $0 $45,000 8 $20,000 $0 $0 $8,880 $5,600 $0 $0 $o 9 $0 $0 $0 $8,920 $5,600 $0 $0 $0 10 $0 $o $0 $8,960 $5,600 $0 $0 $0 11 $0 $0 $0 $9,000 $5,600 $0 $0 $0 12 $0 $0 $0 $9,020 $5,600 $0 $0 $0 프 프 13 $0 $0 $0 $9,020 $5,600 $0 $0 $0 14 $0 $0 $0 $9,040 $5,600 $0 $0 $0 15 $200,000 ($40,000) $5,600 $0 $0 $0 $66,200 $43,300 $200,000 $71,220 $84,000 $44,000 $51,200 $83,000 Sum of cash-flow benefits Excess of cash flow over initial investment $26,200 $3,300 $160,000 $31,220 $44,000 $4,000 $11,200 $43,000

没有找到相关结果