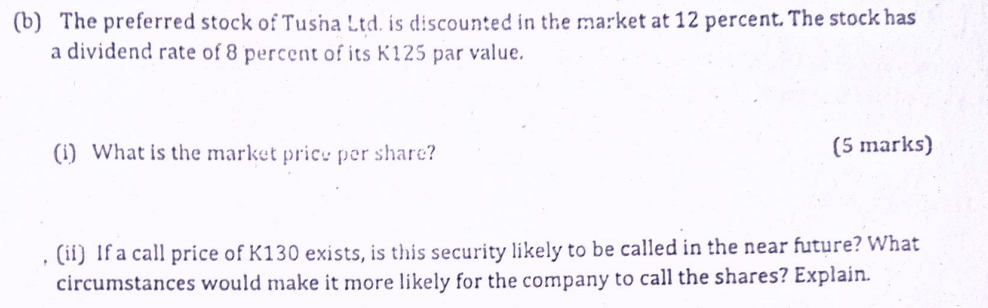

(b) The preferred stock of Tushaltd, is discounted in the market at 12 percent. The stock has a dividend rate of 8 percent of its k125 par value. (i) What is the market pricu per share? (5 marks) (ii) If a call price of K130 exists, is this security likely to be called in the near future? What circumstances would make it more likely for the company to call the shares? Explain.

没有找到相关结果