needin 30 mins please

needin 30 mins please

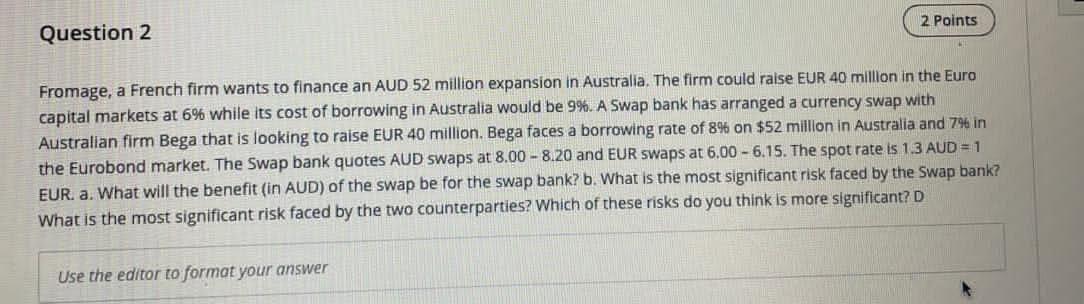

2 Points Question 2 Fromage, a French firm wants to finance an AUD 52 million expansion in Australia. The firm could raise EUR 40 million in the Euro capital markets at 6% while its cost of borrowing in Australia would be 9%. A Swap bank has arranged a currency swap with Australian firm Bega that is looking to raise EUR 40 million. Bega faces a borrowing rate of 8% on $52 million in Australia and 796 in the Eurobond market. The Swap bank quotes AUD swaps at 8.00 - 8.20 and EUR swaps at 6.00 - 6.15. The spot rate is 1.3 AUD = 1 EUR. a. What will the benefit (in AUD) of the swap be for the swap bank? b. What is the most significant risk faced by the Swap bank? What is the most significant risk faced by the two counterparties? Which of these risks do you think is more significant? D Use the editor to format your answer

没有找到相关结果