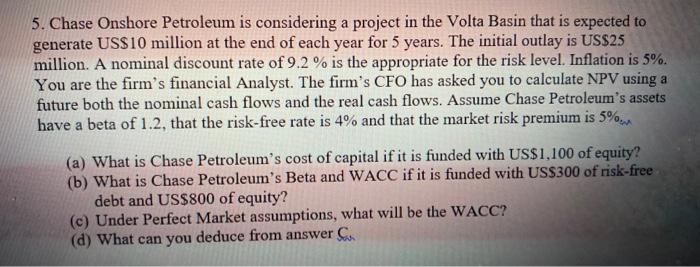

5. Chase Onshore Petroleum is considering a project in the Volta Basin that is expected to generate US$10 million at the end of each year for 5 years. The initial outlay is US$25 million. A nominal discount rate of 9.2 % is the appropriate for the risk level. Inflation is 5%. You are the firm's financial Analyst. The firm's CFO has asked you to calculate NPV using a future both the nominal cash flows and the real cash flows. Assume Chase Petroleum's assets have a beta of 1.2, that the risk-free rate is 4% and that the market risk premium is 5%. (a) What is Chase Petroleum's cost of capital if it is funded with US$1,100 of equity? (b) What is Chase Petroleum's Beta and WACC if it is funded with US$300 of risk-free debt and US$800 of equity? (c) Under Perfect Market assumptions, what will be the WACC? (d) What can you deduce from answer C.

没有找到相关结果