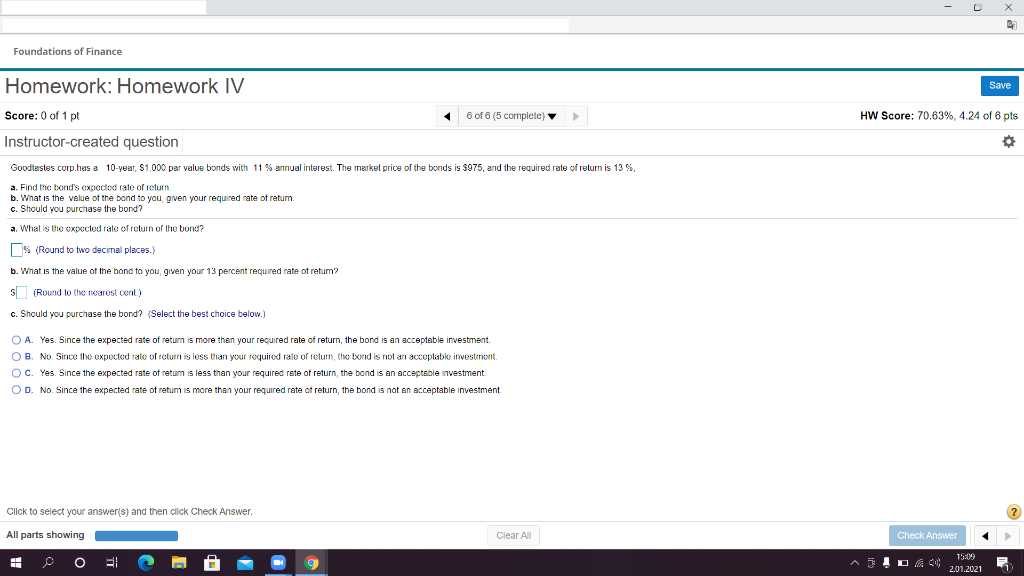

Foundations of Finance Homework: Homework IV Save Score: 0 of 1 pt 6 of 6 (5 complete) HW Score: 70.63%, 4.24 of 6 pts Instructor-created question Goodtastes corp.has a 10-year, $1,000 par value bonds with 11% annual interest. The market price of the bonds is $975, and the required rate of return is 13%, a. Find the bond's expected rate of return b. What is the value of the bond to you, given your required rate of retum c. Should you purchase the bond? a. What is the expected rate of return of the bonu? $ (Round to two decimal places.) b. What is the value of the bond to you given your 13 percent required rate of retum? SI (Round to the nearest cent) c. Should you purchase the bond? (Select the best choice below.) OA. Yes. Since the expected rate of return is more than your required rate of return, the bond is an acceptable investment. OB. No. Since the expected rate of return is less than your required rate of return, the bond is not an acceptable investment OC. Yes. Since the expected rate of return is less than your required rate of return, the bond is an acceptable investment. OD. No. Since the expected rate of retum is more than your required rate of return the bond is not an acceptable investment Click to select your answer(s) and then click Check Answer. ? All parts showing Clear All Check Answer OM 2.01.2021

没有找到相关结果