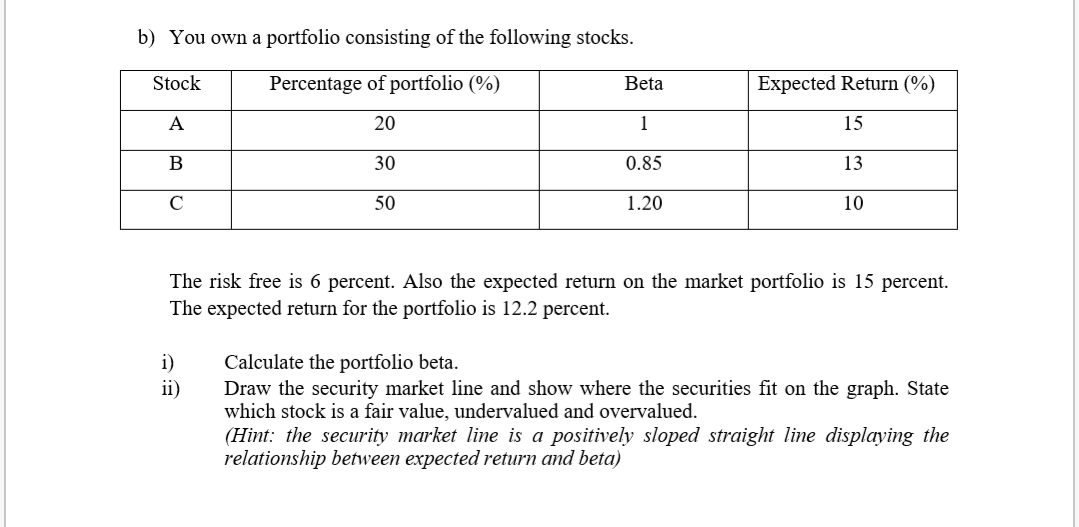

b) You own a portfolio consisting of the following stocks. Stock Percentage of portfolio (%) Beta Expected Return (%) A 20 1 15 B 30 0.85 13 с 50 1.20 10 The risk free is 6 percent. Also the expected return on the market portfolio is 15 percent. The expected return for the portfolio is 12.2 percent. i) ii) Calculate the portfolio beta. Draw the security market line and show where the securities fit on the graph. State which stock is a fair value, undervalued and overvalued. (Hint: the security market line is a positively sloped straight line displaying the relationship between expected return and beta)

没有找到相关结果