Note: Please answer the Excel program using the Excelformulas.

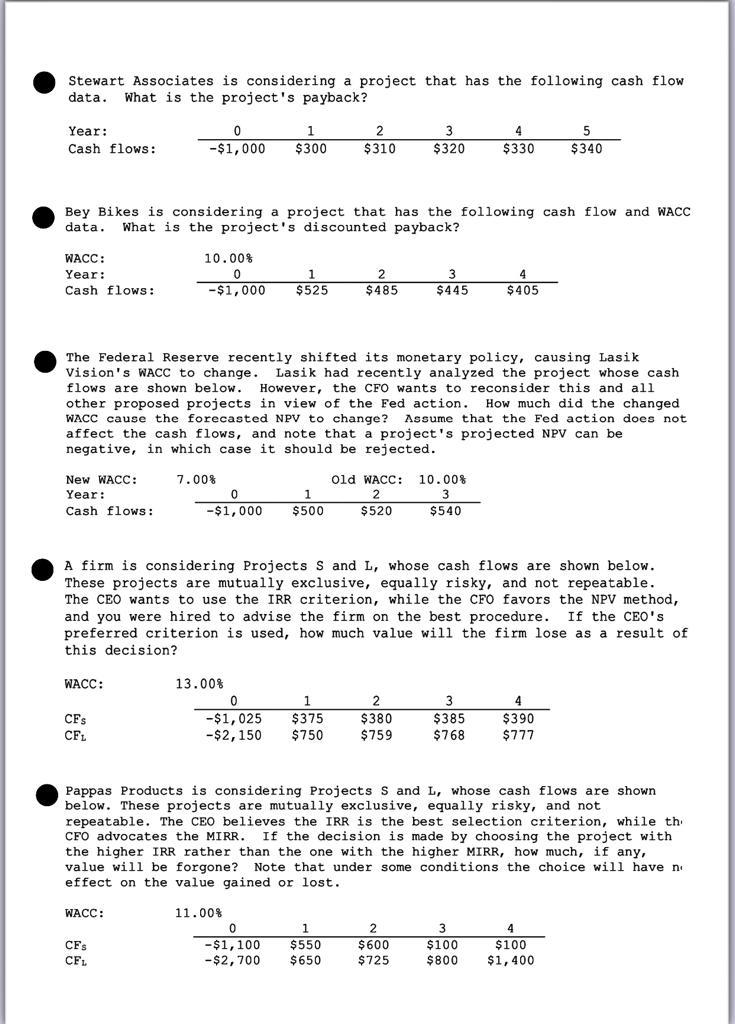

Stewart Associates is considering a project that has the following cash flow data. What is the project's payback? Year: Cash flows: 0 -$1,000 1 $300 2 $310 3 $320 4 $330 5 $340 Bey Bikes is considering a project that has the following cash flow and WACC data. What is the project's discounted payback? WACC: Year: Cash flows: 10.00% 0 -$1,000 1 $525 2 $485 $445 $405 The Federal Reserve recently shifted its monetary policy, causing Lasik Vision's WACC to change. Lasik had recently analyzed the project whose cash flows are shown below. However, the CFO wants to reconsider this and all other proposed projects in view of the Fed action. How much did the changed WACC cause the forecasted NPV to change? Assume that the Fed action does not affect the cash flows, and note that a project's projected NPV can be negative, in which case it should be rejected. New WACC: 7.00% Year: 0 -$1,000 1 $500 old WACC: 10.00% 2 3 $520 $540 Cash flows: A firm is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO wants to use the IRR criterion, while the CFO favors the NPV method, and you were hired to advise the firm on the best procedure. If the CEO's preferred criterion is used, how much value will the firm lose as a result of this decision? WACC: 13.00% 0 -$1,025 -$2,150 CFS CFL 1 $375 $750 2 $380 $ 759 $385 $768 4 $390 $777 Pappas Products is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while th CFO advocates the MIRR. If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR, how much, if any, value will be forgone? Note that under some conditions the choice will have no effect on the value gained or lost. WACC: 11.00% 0 -$1,100 -$2,700 CFS CF. 1 $550 $650 2 $600 $725 3 $100 $800 4 $100 $1,400

没有找到相关结果