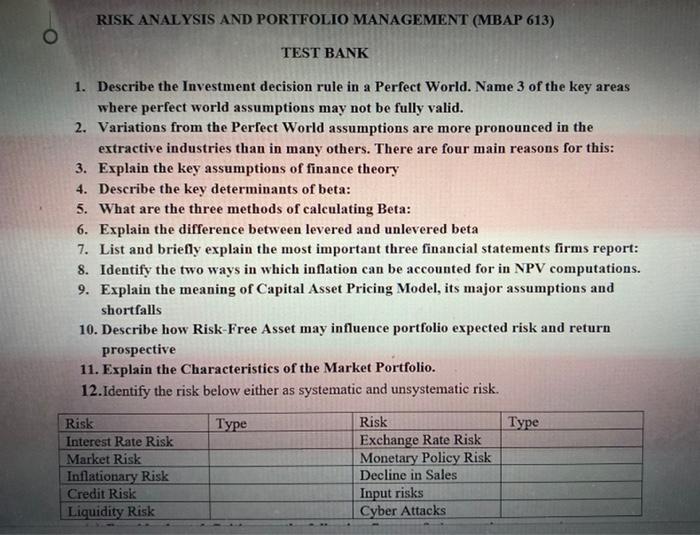

RISK ANALYSIS AND PORTFOLIO MANAGEMENT (MBAP 613) TEST BANK 1. Describe the Investment decision rule in a Perfect World. Name 3 of the key areas where perfect world assumptions may not be fully valid. 2. Variations from the Perfect World assumptions are more pronounced in the extractive industries than in many others. There are four main reasons for this: 3. Explain the key assumptions of finance theory 4. Describe the key determinants of beta: 5. What are the three methods of calculating Beta: 6. Explain the difference between levered and unlevered beta 7. List and briefly explain the most important three financial statements firms report: 8. Identify the two ways in which inflation can be accounted for in NPV computations. 9. Explain the meaning of Capital Asset Pricing Model, its major assumptions and shortfalls 10. Describe how Risk Free Asset may influence portfolio expected risk and return prospective 11. Explain the Characteristics of the Market Portfolio. 12. Identify the risk below either as systematic and unsystematic risk. Type Type Risk Interest Rate Risk Market Risk Inflationary Risk Credit Risk Liquidity Risk Risk Exchange Rate Risk Monetary Policy Risk Decline in Sales Input risks Cyber Attacks

没有找到相关结果