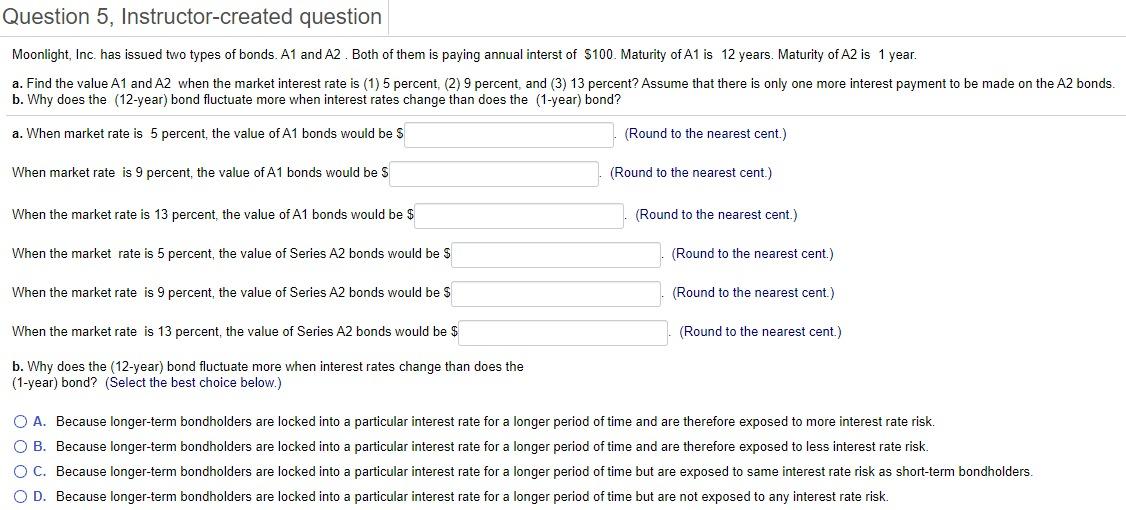

Question 5, Instructor-created question Moonlight, Inc. has issued two types of bonds. A1 and A2. Both of them is paying annual interst of $100. Maturity of A1 is 12 years. Maturity of A2 is 1 year. a. Find the value A1 and A2 when the market interest rate is (1) 5 percent, (2) 9 percent, and (3) 13 percent? Assume that there is only one more interest payment to be made on the A2 bonds. b. Why does the 12-year) bond fluctuate more when interest rates change than does the (1-year) bond? a. When market rate is 5 percent, the value of A1 bonds would be s (Round to the nearest cent.) When market rate is 9 percent, the value of A1 bonds would be s (Round to the nearest cent.) When the market rate is 13 percent, the value of A1 bonds would be $ (Round to the nearest cent.) When the market rate is 5 percent, the value of Series A2 bonds would be s (Round to the nearest cent.) When the market rate is 9 percent, the value of Series A2 bonds would be $ (Round to the nearest cent.) When the market rate is 13 percent, the value of Series A2 bonds would be $ (Round to the nearest cent.) b. Why does the 12-year) bond fluctuate more when interest rates change than does the (1-year) bond? (Select the best choice below.) O A. Because longer-term bondholders are locked into a particular interest rate for a longer period of time and are therefore exposed to more interest rate risk. O B. Because longer-term bondholders are locked into a particular interest rate for a longer period of time and are therefore exposed to less interest rate risk. OC. Because longer-term bondholders are locked into a particular interest rate for a longer period of time but are exposed to same interest rate risk as short-term bondholders. O D. Because longer-term bondholders are locked into a particular interest rate for a longer period of time but are not exposed to any interest rate risk.

没有找到相关结果