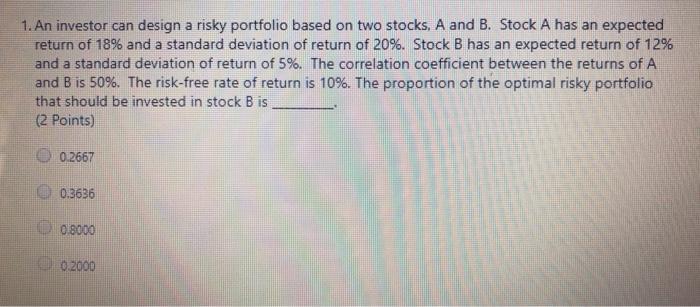

1. An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 18% and a standard deviation of return of 20%. Stock B has an expected return of 12% and a standard deviation of return of 5%. The correlation coefficient between the returns of A and B is 50%. The risk-free rate of return is 10%. The proportion of the optimal risky portfolio that should be invested in stock B is (2 Points) O 0.2667 0.3636 0 8000 0.2000

没有找到相关结果