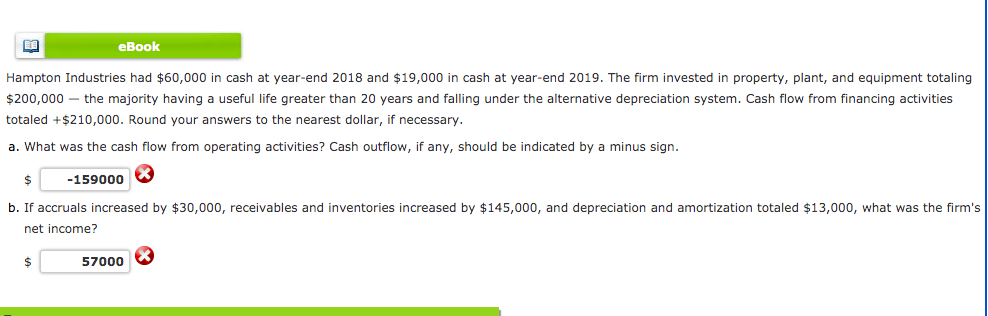

eBook Hampton Industries had $60,000 in cash at year-end 2018 and $19,000 in cash at year-end 2019. The firm invested in property, plant, and equipment totaling $200,000 – the majority having a useful life greater than 20 years and falling under the alternative depreciation system. Cash flow from financing activities totaled +$210,000. Round your answers to the nearest dollar, if necessary. a. What was the cash flow from operating activities? Cash outflow, if any, should be indicated by a minus sign. $ -159000 X b. If accruals increased by $30,000, receivables and inventories increased by $145,000, and depreciation and amortization totaled $13,000, what was the firm's net income? $ 57000

没有找到相关结果