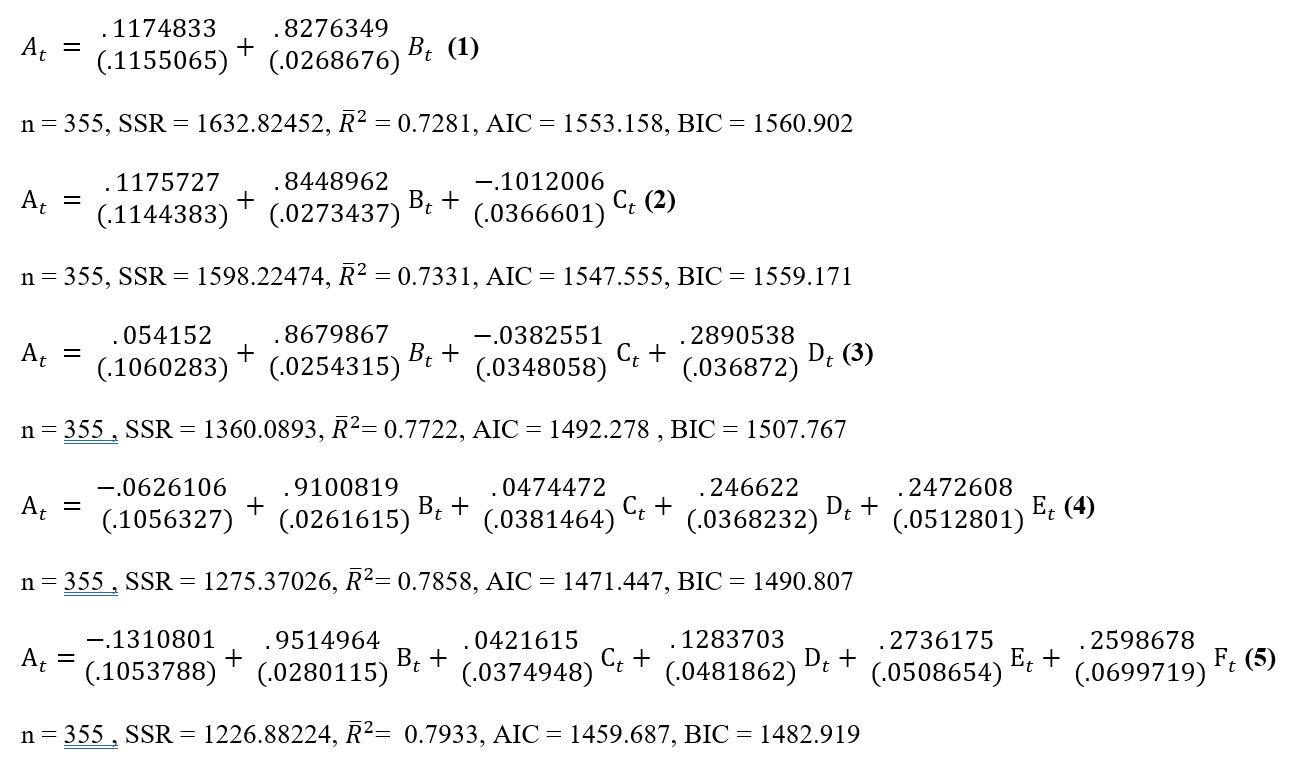

iv. Which OLS regression model below, would you chooseas an asset pricing model and why? [15 marks]

Standard error is in brackets underneath parameter estimate.

OLS regression models were derived from the variables below:

| A | Excess return on the portfolio | Risk factor associated with the portfolio |

| B | Excess return on the market* | Risk factor associated with the overall market |

| C | Small minus Big | Risk factor associated with the size of stocks |

| D | High minus Low | Risk factor associated with the value of stocks |

| E | Robust minus Weak | Risk factor associated with the profitability of stocks |

| F | Conservative minus Aggressive | Risk factor associated with the investment style ofstocks |

At 1174833 .8276349 + (.1155065) * 0.0268676) Bt (1) n=355, SSR = 1632.82452, R2 = 0.7281, AIC = 1553.158, BIC = 1560.902 At = 1175727 + (.1144383) .8448962 -.1012006 (.0273437) B: + (.0366601) Ct (2) n=355, SSR = 1598.22474, R2 = 0.7331, AIC = 1547.555, BIC = 1559.171 At 054152 8679867 + (.1060283) 0.0254315) Bet -.0382551 Ct + (.0348058) 2890538 0.036872) Dt (3) n= 355, SSR = 1360.0893, R2=0.7722, AIC = 1492.278 , BIC = 1507.767 At -.0626106 + (.1056327) 9100819 (.0261615) B: + .0474472 (.0381464) Ct + .246622 D. + (.0368232) .2472608 (.0512801) Et (4) n=355, SSR = 1275.37026, R2= 0.7858, AIC = 1471.447, BIC = 1490.807 . At = -.1310801 + (.1053788) .9514964 (.0280115) Bc + 0421615 (.0374948) Ct + 1283703 .2736175 (.0481862) Dt + (.0508654) Et + .2598678 (.0699719) Ft (5) n=355, SSR = 1226.88224, R2= 0.7933, AIC = 1459.687, BIC = 1482.919

没有找到相关结果