Why does the offer price at which NPV turns negative representthe maximum offer price?

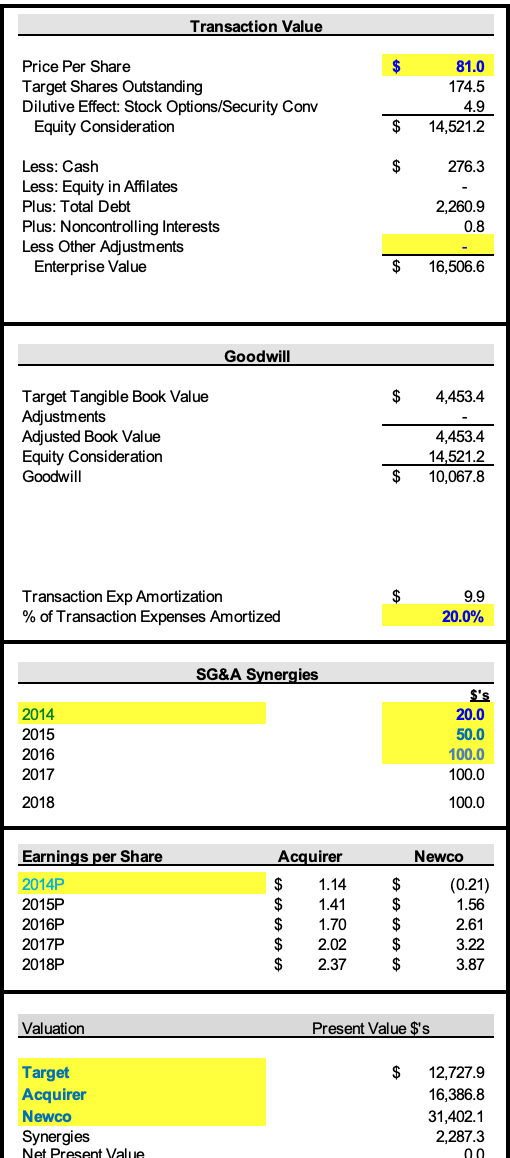

Transaction Value $ Price Per Share Target Shares Outstanding Dilutive Effect: Stock Options/Security Conv Equity Consideration 81.0 174.5 4.9 14,521.2 $ $ 276.3 Less: Cash Less: Equity in Affilates Plus: Total Debt Plus: Noncontrolling Interests Less Other Adjustments Enterprise Value 2,260.9 0.8 $ 16,506.6 Goodwill $ 4,453.4 Target Tangible Book Value Adjustments Adjusted Book Value Equity Consideration Goodwill 4,453.4 14,521.2 10,067.8 $ $ Transaction Exp Amortization % of Transaction Expenses Amortized 9.9 20.0% SG&A Synergies 2014 2015 2016 2017 $'s 20.0 50.0 100.0 100.0 2018 100.0 Acquirer Newco Earnings per Share 2014P 2015P 2016P 2017P 2018P $ $ $ $ $ 1.14 1.41 1.70 2.02 2.37 $ $ $ $ $ (0.21) 1.56 2.61 3.22 3.87 Valuation Present Value $'s $ Target Acquirer Newco Synergies Net Present Value 12,727.9 16,386.8 31,402.1 2,287.3

没有找到相关结果