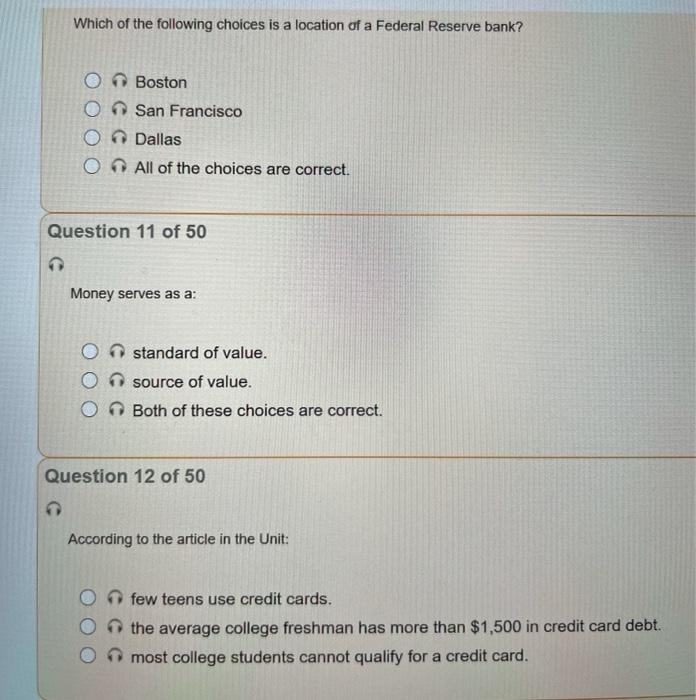

Which of the following choices is a location of a Federal Reserve bank? Boston O San Francisco Dallas All of the choices are correct. Question 11 of 50 Money serves as a standard of value. O source of value. O Both of these choices are correct. Question 12 of 50 According to the article in the Unit: few teens use credit cards. the average college freshman has more than $1,500 in credit card debt. most college students cannot qualify for a credit card. Question 13 of 50 Beads and salt are examples of commodity money. O False True Question 14 of 50 Social Security retirement is a program that provides benefits to: individuals 62 or older. disabled individuals. O low-income individuals. Question 15 of 50 A bank with a 20% reserve ratio would only be allowed to loan out 20% of their deposits. False True Question 16 of 50 Commercial banks: O are owned by depositors. Oare for-profit businesses. O do not loan out money. Question 17 of 50 With a progressive tax: wealthy individuals pay less in taxes than low-income individuals. the tax rate is the same for all individuals. O wealthy individuals pay more in taxes than low-income individuals. Question 18 of 50 The top-earning fifth of U.S. households receives: more than 50% of the nation's total income. 75% of the nation's total income. less than 10% of the nation's total income. Question 19 of 50 Interest is money paid to a bank in exchange for a checking account. O True O False Question 20 of 50 The concept of a bank can be traced back to the: 1800s. Middle Ages. O 21st century. Question 21 of 50 The term recession refers to an economic slowdown that lasts for longer than: a year. 6 months. 5 years. Which of the following choices is not one of the three major services banks provide? O making loans O accepting deposits O setting interest rates Question 23 of 50 During a period of inflation, prices decrease. True O False Question 24 of 50 According to U.S. law, children under the age of 16: cannot work during school hours. can only work one weekend a month. can work at any type of job. must be paid more than minimum wage. Question 25 of 50 Advances in technology have: All of these choices are correct. eliminated the need for paper currency. allowed the U.S. to develop more complex currency notes that are more difficult to counterfeit. 7 decreased the responsibilities of the Fed. Question 26 of 50 In times of economic prosperity, people usually spend more money. False True Question 27 of 50 The majority of U.S. tax revenue comes from: sales taxes. income taxes. social insurance taxes. Question 28 of 50 According to the Unit, the U.S. government spends the majority of its income on: national defense. Onet interest. direct payments to individuals. Ogrants to local governments. Question 29 of 50 In the U.S., income tax rates do not vary according to income levels. False True Question 30 of 50 The first bankers were farmers who traded horses for gold. False True

没有找到相关结果