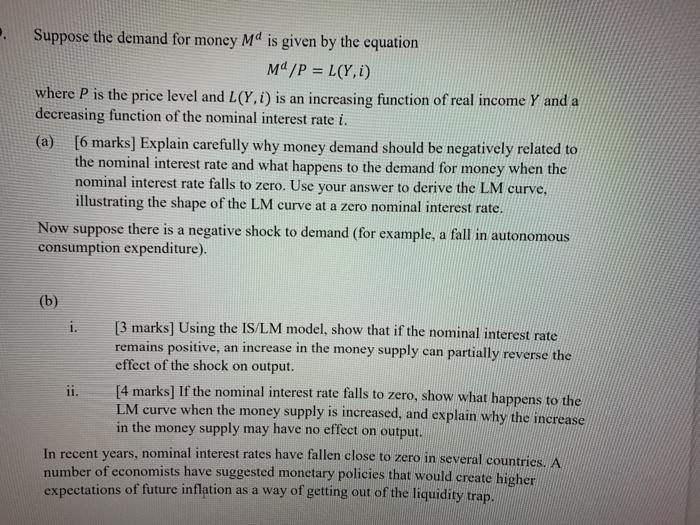

. Suppose the demand for money Md is given by the equation Md/P = L(Y,1) where P is the price level and L(Y.L) is an increasing function of real income Y and a decreasing function of the nominal interest rate i. (a) [6 marks] Explain carefully why money demand should be negatively related to the nominal interest rate and what happens to the demand for money when the nominal interest rate falls to zero. Use your answer to derive the LM curve, illustrating the shape of the LM curve at a zero nominal interest rate. Now suppose there is a negative shock to demand (for example, a fall in autonomous consumption expenditure). (b) i. [3 marks] Using the IS/LM model, show that if the nominal interest rate remains positive, an increase in the money supply can partially reverse the effect of the shock on output. ii. [4 marks] If the nominal interest rate falls to zero, show what happens to the LM curve when the money supply is increased, and explain why the increase in the money supply may have no effect on output. In recent years, nominal interest rates have fallen close to zero in several countries. A number of economists have suggested monetary policies that would create higher expectations of future inflation as a way of getting out of the liquidity trap. Suppose the demand for money M is given by the equation M/P = L(Y,0) where P is the price level and L(Y.1) is an increasing function of real income Y and a decreasing function of the nominal interest rate i. (a) [6 marks] Explain carefully why money demand should be negatively related to the nominal interest rate and what happens to the demand for money when the nominal interest rate falls to zero. Use your answer to derive the LM curve, illustrating the shape of the LM curve at a zero nominal interest rate. Now suppose there is a negative shock to demand (for example, a fall in autonomous consumption expenditure). (b) [3 marks] Using the IS/LM model, show that if the nominal interest rate remains positive, an increase in the money supply can partially reverse the effect of the shock on output. [4 marks] If the nominal interest rate falls to zero, show what happens to the LM curve when the money supply is increased, and explain why the increase in the money supply may have no effect on output. In recent years, nominal interest rates have fallen close to zero in several countries. A number of economists have suggested monetary policies that would create higher expectations of future inflation as a way of getting out of the liquidity trap. (c) i. 11. [3 marks] Write down the Fisher equation that links the nominal and real interest rates and use this equation to explain why an increase in inflation expectations would raise output for an economy in a liquidity trap. [4 marks] Suppose the central bank proposes to raise inflation expectations by committing to a future monetary expansion if unemployment remains high. Use the AD/AS model to study the effects of this policy on the price level if the economy remains in the liquidity trap. Comment on the credibility of the policy in light of your answer.

没有找到相关结果