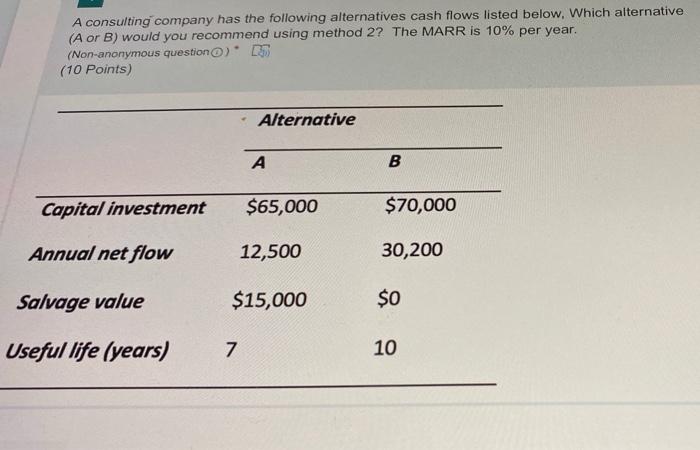

A consulting company has the following alternatives cash flows listed below. Which alternative (A or B) would you recommend using method 2? The MARR is 10% per year. (Non-anonymous question o) (10 Points) Alternative A B Capital investment $65,000 $70,000 Annual net flow 12,500 30,200 Salvage value $15,000 $0 Useful life (years) 7 10

没有找到相关结果