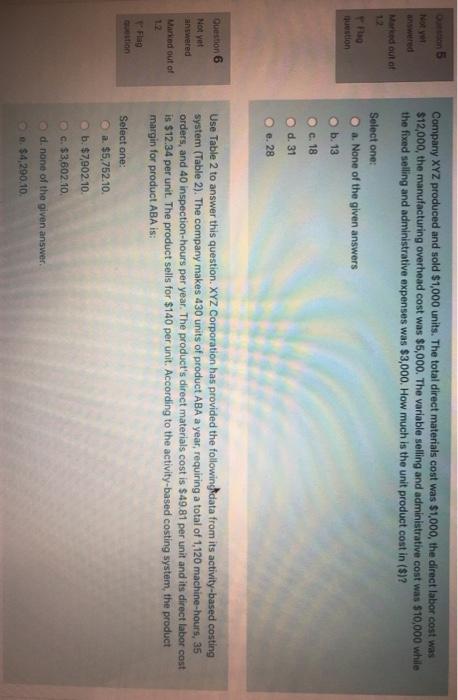

5 Noty answered Marked out at Company XYZ produced and sold $1,000 units. The total direct materials cost was $1,000, the direct labor cost was $12,000, the manufacturing overhead cost was $5,000. The variable selling and administrative cost was $10,000 while the fised selling and administrative expenses was $3,000. How much is the unit product cost in ($)? Frog question Select one: a. None of the given answers b. 13 c. 18 d. 31 O e. 28 Question 6 Not yet answered Use Table 2 to answer this question. XYZ Corporation has provided the following data from its activity-based costing system (Table 2). The company makes 430 units of product ABA a year, requiring a total of 1,120 machine-hours, 35 orders, and 40 inspection-hours per year. The product's direct materials cost is $49.81 per unit and its direct labor cost is $12.34 per unit. The product sells for $140 per unit. According to the activity-based costing system, the product margin for product ABA is: Marked out of 1.2 Flag Select one: a $5,752.10. b. $7,902.10 c. $3,602.10. d. none of the given answer. $4,200.10 Activity Cost Pool Assembly Processing orders Inspection Table 2 Total Cost Total Activity $ 1,114,920 57,000 machine-hours $ 47,016 1,800 orders $ 107,328 1,560 inspection-hours

没有找到相关结果