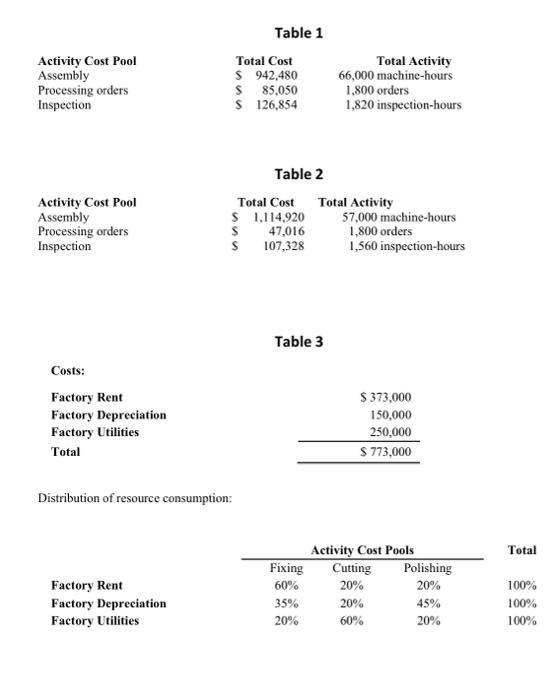

Activity Cost Pool Assembly Processing orders Inspection Table 1 Total Cost S942.480 $ 85,050 $ 126,854 Total Activity 66,000 machine-hours 1.800 orders 1,820 inspection-hours Activity Cost Pool Assembly Processing orders Inspection Table 2 Total Cost Total Activity $ 1,114,920 57,000 machine-hours 47,016 1,800 orders $ 107,328 1,560 inspection hours Table 3 Costs: Factory Rent Factory Depreciation Factory Utilities Total $ 373.000 150,000 250,000 $ 773,000 Distribution of resource consumption: Total Factory Rent Factory Depreciation Factory Utilities Activity Cost Pools Fixing Cutting Polishing 60% 20% 35% 20% 45% 20% 60% 20% 20% 100% 100% 100% Company XYZ produced and sold $1,000 units. The total direct materials cost was $1,000, the direct labor cost was $21,000, the manufacturing overhead cost was $5,000. The variable selling and administrative cost was $13,000 while the fixed selling and administrative expenses was $3,000. How much is the unit product cost in ($)? Select one: O a. 27 O b. 43 O c. 22 O d. 40 e. None of the given answers XYZ Co has an activity-based costing system with three activity cost pools--Fixing, Cutting, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and factory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow: Overhead costs: $79,600 Factory depreciation Indirect labor Distribution of Resource Consumption Across Activity Cost Pools: $5,000 Activity Cost Pools Fixing Cutting Other Equipment depreciation 0.50 0.30 0.20 Factory expense 0.50 0.30 0.20 Fixing costs are assigned to products using machine-hours (MHs) and Cutting costs are assigned to products using the number of orders. The costs in the other activity cost pool are not assigned to products. Activity data for the company's two products follow: Fixing Cutting Other Equipment depreciation 0.50 0.30 0.20 Factory expense 0.50 0.30 0.20 Fixing costs are assigned to products using machine-hours (MHs) and Cutting costs are assigned to products using the number of orders. The costs in the other activity cost pool are not assigned to products. Activity data for the company's two products follow: Machine-hours (Fixing) Orders (Cutting) Product A 1,550 1,070 Product B 9,700 1,630 The activity rate for the Cutting activity cost pool under activity-based costing is closest to (Round your intermediate calculations to 2 decimal place) A Select one: O a. none of the given answer. O b.694.00 per order O c. $6.83 per order O d. $9.40 per order e. $6.40 per order

没有找到相关结果