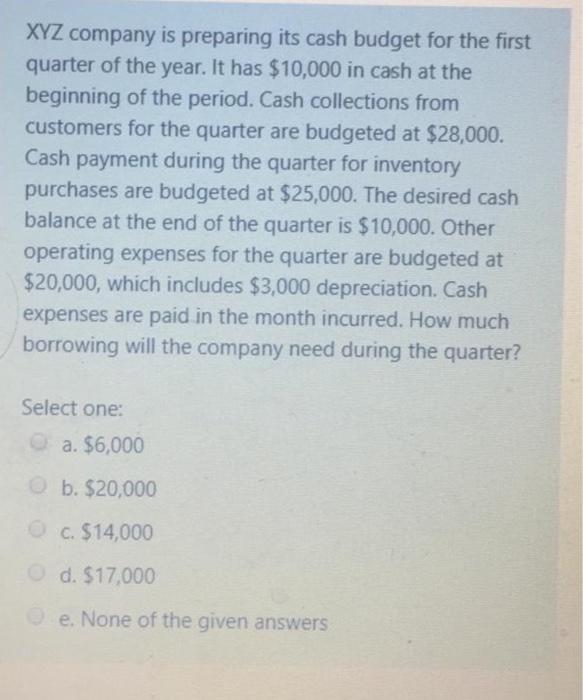

XYZ company is preparing its cash budget for the first quarter of the year. It has $10,000 in cash at the beginning of the period. Cash collections from customers for the quarter are budgeted at $28,000. Cash payment during the quarter for inventory purchases are budgeted at $25,000. The desired cash balance at the end of the quarter is $10,000. Other operating expenses for the quarter are budgeted at $20,000, which includes $3,000 depreciation. Cash expenses are paid in the month incurred. How much borrowing will the company need during the quarter? Select one: a. $6,000 b. $20,000 c. $14,000 d. $17,000 e. None of the given answers

XYZ Company produces and sells one product. The budgeted selling price per unit is $30. Budgeted unit sales for July, August, September, October and November are 1,400 units, 2,100 units, 3,400 units, 2.700 units and 4,200 units, respectively. All sales are on credit. Regarding credit sales, 30% are collected in the month of the sale, 50% in the month following sales, and the remaining 20% in the second month following sale. The expected total cash collections in September is closest to: Select one: a. $70.500 b. None of the given answers | cs92250 d. $96.300 e. 594,000

没有找到相关结果