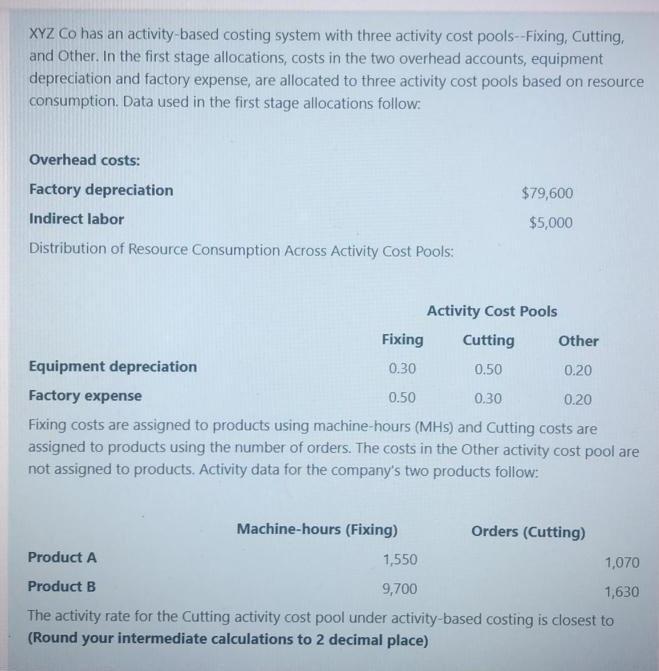

XYZ Co has an activity-based costing system with three activity cost pools--Fixing, Cutting, and other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and factory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow: Overhead costs: Factory depreciation $79,600 Indirect labor $5,000 Distribution of Resource Consumption Across Activity Cost Pools: Activity Cost Pools Fixing Cutting Other Equipment depreciation 0.30 0.50 0.20 Factory expense 0.50 0.30 0.20 Fixing costs are assigned to products using machine-hours (MHs) and Cutting costs are assigned to products using the number of orders. The costs in the other activity cost pool are not assigned to products. Activity data for the company's two products follow: Machine-hours (Fixing) Orders (Cutting) Product A 1,550 1,070 Product B 9,700 1,630 The activity rate for the Cutting activity cost pool under activity-based costing is closest to (Round your intermediate calculations to 2 decimal place)

没有找到相关结果