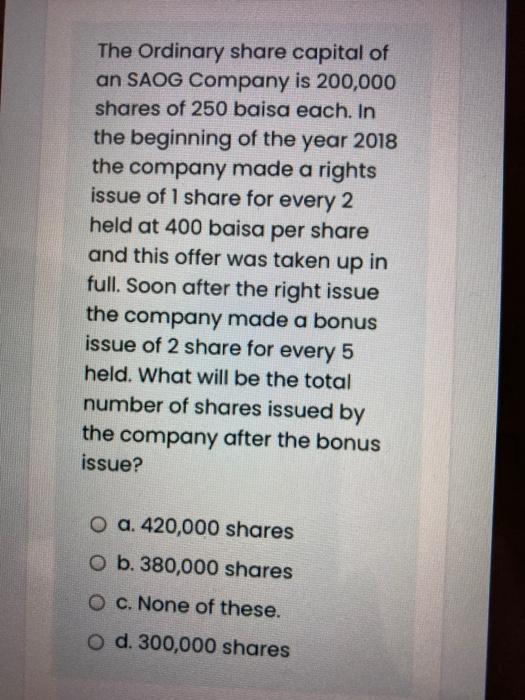

The Ordinary share capital of an SAOG Company is 200,000 shares of 250 baisa each. In the beginning of the year 2018 the company made a rights issue of 1 share for every 2 held at 400 baisa per share and this offer was taken up in full. Soon after the right issue the company made a bonus issue of 2 share for every 5 held. What will be the total number of shares issued by the company after the bonus issue? O a. 420,000 shares O b. 380,000 shares O c. None of these. O d. 300,000 shares

An SAOG Company offered 5,000,000 shares of OMR 1 each to the public for subscription. The company received applications for 5,045,000 shares. The company finalized the allotment on 5,000,000 shares and rejected applications for 45,000 shares. The company called up OMR 0.600. The company received the entire amount except on 5,250 shares on which call money has not been received. Which one of the following is the paid up capital? O a. OMR 3,023,850 o b. OMR 3,000,000 O c. OMR 2,996,850 O d. OMR 3,027,000

PLR Company has 120,000 preferred stock of 8 % with a face value of OMR 2 outstanding on 31 December 2017. The board of directors of the company declared a cash dividend of OMR 150,000 on December 2019. If the preferred stock is non- cumulative and the entity undistributed dividend for last two years, what will be the amount of dividend available to preferred stock holders? O a OMR 92,400 O b. OMR 19,200 O c. OMR 57,600 O d. OMR 38,400

PQR SAOG has issued and paid up capital of OMR 4 million consisting of ordinary shares of OMR 0.600 each. The current market price of each share is OMR 2.400. The company board decided a 3- for-1 stock split. What will be the market price of each share after the stock split? O a. OMR 0.600 O b. OMR 0.800 O c. OMR 1.200 O d. None of these.

Salam International Company issued 100,000 shares of OMR 1 each. Company finalized the allotment on 100,000 shares and called up OMR 0.750. Company received the entire amount except on 2,850 shares on which call money has not been received. In which of the following accounts, company will categorize the amount of 2,850 shares? O a. In the called up and calls in areas. o b. In the called up and paid capital O c. None of these. O d. In the paid up and calls in areas.

MP Corporation has 50,000 stocks of 12%, OMR5 face value, preferred stock outstanding on December 31, 2018. On December 31, 2019, the board of directors declared a OMR100,000 "Cash dividend". What will be the amount of dividend available to equity shareholders if the preference stock is cumulative and the company did not distribute the dividend for the last two years? O a. OMR 60,000 O b. OMR 30,000 O c. OMR 50,000 O d. OMR 40,000

Power Corporation has in issue 500,000 ROlequity shares with a current market value of RO 3 each. It offers a rights issue of 2 for 5 shares at an offer price of RO 2.50. The offer is fully taken up by all shareholders. What will be the amount of right issue share capital? O a OMR 1,250,000 O b. OMR 500,000 O c. OMR 200,000 O d. OMR 600,000

The board of directors of ABC Company recently announced a 6% stock dividend. Assuming that the current stock price is OMR 5 and there are 200,000 total ordinary shares outstanding of OMR 1 each. What is the amount of market capitalization of the company before the stock dividend? O a. None of these. o b. OMR 200,000 O c. OMR 1,500,000 O d. OMR 1,000,000

A company's profit after tax for the year 31st December 2019 was OMR 200,000. The company's issued share capital at Ist January 2018 consisted of 100,000 ordinary shares. Company made a l for 2 rights issue on Ist July 2019 at OMR 0.400 per share and this was fully subscribed. The market value of the company's shares just before the rights issue was OMR 1.5 per share. The TERP is: O a. OMR 0.80 O b. OMR 0.60 O c. OMR 1.200 O d. OMR 1.00

PQR Corporation has been around for three years. During this time, it reported the following net income: • Year 1: RO (38,000) • Year 2: RO (12,000) • Year 3: RO 213,000 PQR Corporation paid no dividends till year 2 but for year 3 it paid dividend @ 100 baiza each on its equity shares. The company till then had issued 200,000 share of RO 0.500 each fully paid. What is the amount of retained earnings balance after the completion of three years? O a OMR 123,000 O b. OMR 23,000 O C. OMR 143,000 O d. OMR 173,000

PQR Corporation has been around for three years. During this time, it reported the following net income: • Year 1: RO (38,000) • Year 2: RO (12,000) • Year 3: RO 213,000 PQR Corporation paid no dividends till year 2 but for year 3 it paid dividend @ 100 baiza each on its equity shares. The company till then had issued 200,000 share of RO 0.500 each fully paid. What is the amount of retained earnings balance after the completion of three years? O a. OMR 123,000 O b. OMR 23,000 O c. OMR 143,000 O d. OMR 173,000

Holland Corporations has 100,000 total ordinary shares outstanding with a face value of OMR 2 each and the market price per share is OMR 10 each. The Board of directors announced a 10% stock dividend on 1 June 2019. What is the market price per share of the Company after stock dividend? O a. OMR9.50 per share O b. OMRI0.00 per share O c. OMR 2.00 per share O d. OMR 9.09 per share

Holland Corporations has 100,000 total ordinary shares outstanding with a face value of OMR 2 each and the market price per share is OMR 10 each. The Board of directors announced a 10% stock dividend on 1 June 2019. What 1 is the market price per share of the Company after stock dividend? o a. OMR9.50 per share O b. OMR10.00 per share O c. OMR 2.00 per share O d. OMR 9.09 per share

Al Fawas Co issues 50,000, ordinary shares of 0.500 Balsa per share for OMR 72,000 What will be the amount of share premium per share? O a OMR 1.44 per share O b. None of these. O c. OMR. 0.500 per share O d. OMR 0.940 per share

An SOAG Company has in issue 500,000 RO 0.400 equity shares with a current market value of RO 0.800 each. It offers a rights issue of 1 for 4 shares at an offer price of RO 0.600. The offer is fully taken up by all shareholders. What is the amount of share capital after the right issue? o a. 250,000 o b. 200,000 O c. 400,000 O d. 500,000

没有找到相关结果