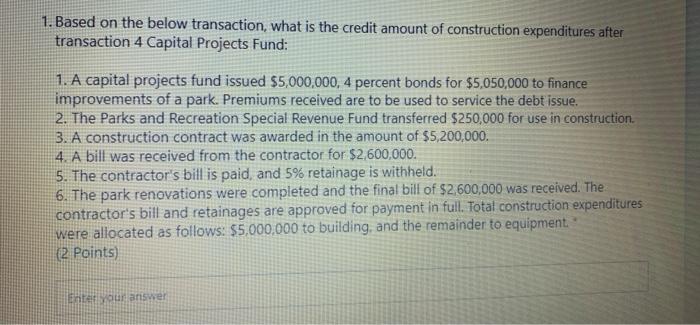

1. Based on the below transaction, what is the credit amount of construction expenditures after transaction 4 Capital Projects Fund: 1. A capital projects fund issued $5,000,000, 4 percent bonds for $5,050,000 to finance improvements of a park. Premiums received are to be used to service the debt issue. 2. The Parks and Recreation Special Revenue Fund transferred $250,000 for use in construction 3. A construction contract was awarded in the amount of $5,200,000. 4. A bill was received from the contractor for $2,600,000. 5. The contractor's bill is paid and 5% retainage is withheld. 6. The park renovations were completed and the final bill of $2,600,000 was received. The contractor's bill and retainages are approved for payment in full. Total construction expenditures were allocated as follows: $5,000,000 to building, and the remainder to equipment (2 Points) Entour answer

没有找到相关结果