need help with 1-3

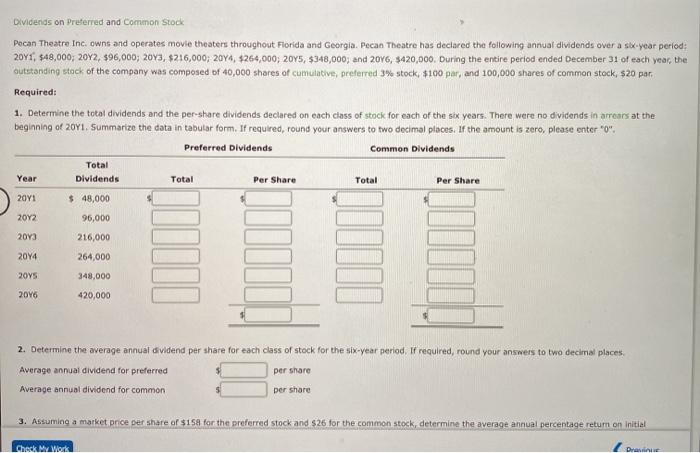

Dividends on Preferred and common Stock Pecan Theatre Inc. owns and operates movie theaters throughout Florida and Georgia. Pecan Theatre has declared the following annual dividends over a six-year period: 20Y1, $48,000; 2012, 596,000; 2013, $216,000; 2014, $264,000; 2045, $348,000; and 2016, $420,000. During the entire period ended December 31 of each year the outstanding stack of the company was composed of 40,000 shares of cumulative, preferred 3% stock $100 par, and 100,000 shares of common stock, $20 par Required: 1. Determine the total dividends and the per-share dividends declared on each class of stock for each of the six years. There were no dividends in arrears at the beginning of 2071. Summarize the data in tabular form. If required, round your answers to two decimal places. If the amount is zero, please enter "O". Preferred Dividends Common Dividends Total Dividends Total Per Share Total Per Share Year 2011 $ 48,000 2012 96,000 2013 216,000 264,000 2014 2015 348,000 2016 420,000 2. Determine the average annual dividend per share for each class of stock for the six-year period. If required, round your answers to two decimal places Average annual dividend for preferred per share Average annual dividend for common per share 3. Assuming a market price per share of $158 for the preferred stock and $26 for the common stock, determine the average annual percentage retum on initial Check My Work Drain 1. Determine the total dividends and the per share dividends declared on each class of stock for each of the six years. There were no dividends in arrears at the beginning of 2071. Summarize the data in tabular form. If required, round your answers to two decimal places. If the amount is zero, please enter "o. Preferred Dividends Common Dividends Year Total Dividends Total Per Share Total Per Share 2013 $ 48,000 2012 96,000 216,000 2093 2014 264,000 2015 348,000 420,000 2046 2. Determine the average annual dividend per share for each class of stock for the six-year period. If required, round your answers to two decimal places Average annual dividend for preferred per share Average annual dividend for common per share 3. Assuming a market price per share of $158 for the preferred stock and $26 for the common stock, determine the average annual percentage return on initial shareholders investment, based on the average annual dividend per share (a) for preferred stock and (b) for common stock, Round your answers to two decimat places Preferred stock % Common stock 4

没有找到相关结果