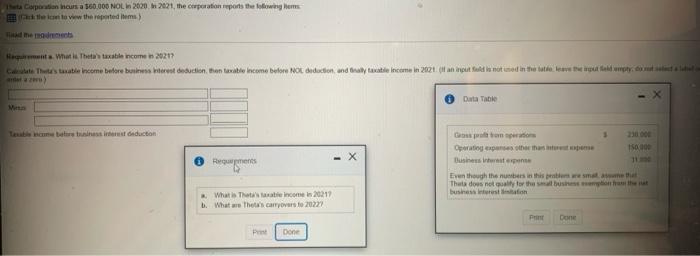

The Corporation Incurs a $60.000 NOL In 2020 2021, the corporation reports the lowing us wito www the reported items Hata What is Theta taxable income in 20217 Ce That Income before benessere deduction the taxable income before NO deduction and all income in 20 if an input is not in the latest Data Table Tabarasseduction Reguments Operations to the 150.00 Dette Even though the numbers in this pats esmaltat Theta do not wait for the small businestret businesses What That's income in 20219 What are the carryovers to 2022! Done Done

Pink Corporation donates the following property to Thomson Elementary School (Click the icon to view the property) The school will set the stock and use the proceeds to renovato a classroom to be used as a computer laboratory, Pink's taxable income before any charitable contributions deduction or dividends-received deduction is $480,000 Read the requirements Requirement a. What is Pink's charitable contributions deduction for the current year? Property Basis) FMV Allowable deduction XYZ Stock ABC Stock POR Stock 1 More Info XYZ Corporation stock purchased two years ago for $24,000. The stock has a $22,000 FMV on the contribution date. ABC Corporation stock purchased three years ago for $3.250. The stock has a $15,000 FMV on the contribution date. . POR Corporation stock purchased six months ago for $14,000. The stock has a $21,000 FMV on the contribution date Print Done

Pink Corporation donates the following property to Thomson Elementary School: Click the icon to view the property.) The school will sell the stock and use the proceeds to renovate a classroom to be used as a computer laboratory. Pink's taxable income before any charitable contributions deduction or dividends-received deduction is $480,000 Read the requirements FMV Requirement a. What is Pink's charitable contributions deduction for the current year? Property Basis Allowable deduction XYZ Stock ABC Stock POR Stock Requirements What is Pink's charitable contributions deduction for the current year? b. What is Pink's charitable contribution carryover (if any)? In what yoаrs can it be used? c. What would have been a better tax plan concerning the XYZ stock donation? Print Done

没有找到相关结果