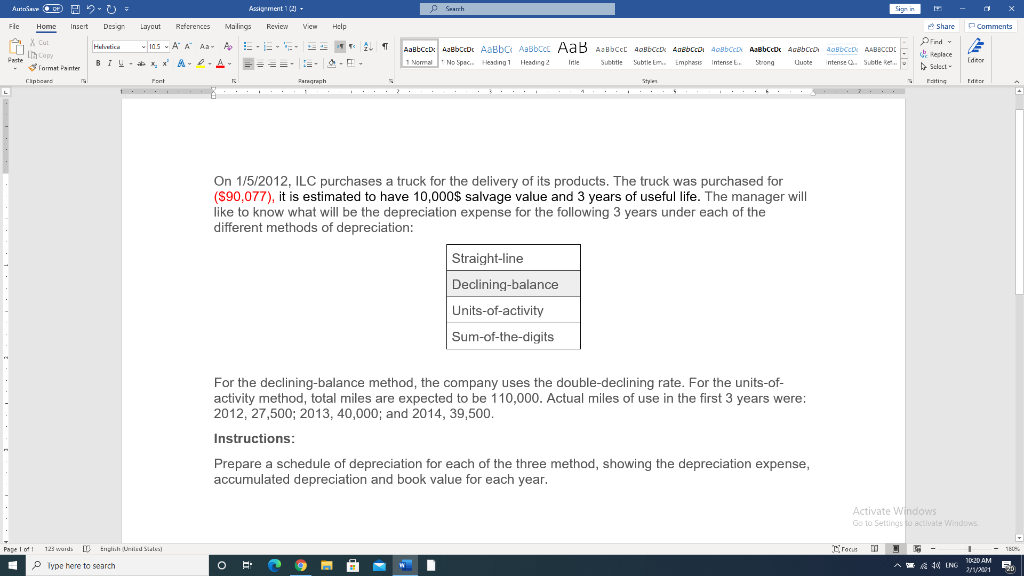

Aurin Assignment (2) * Search Sign in Fle Home Insert Design Layout References Malings Review Vic Help Comments Share Find X Cut - 20 AL 1 Hatica 105 A A A BIU-X APA- AaBbce: ABCD AaBbc Aabbocc AaB Aabbcc 4oBBCCDX 4debcro Abc ABCD Acebo obce A4BBCODE * No Spac. Heading 1 Heading 2 Irtie 1 Normal Subtlem. Empis Intenset. Strong (die Uupte Intense. Sube Red Format Panter Select Clipboard Paragraph Editor L On 1/5/2012, ILC purchases a truck for the delivery of its products. The truck was purchased for ($90,077), it is estimated to have 10,000$ salvage value and 3 years of useful life. The manager will like to know what will be the depreciation expense for the following 3 years under each of the different methods of depreciation: Straight-line Declining-balance Units-of-activity Sum-of-the-digits For the declining-balance method, the company uses the double-declining rate. For the units-of- activity method, total miles are expected to be 110,000. Actual miles of use in the first 3 years were: 2012, 27,500; 2013, 40,000; and 2014, 39,500. Instructions: Prepare a schedule of depreciation for each of the three method, showing the depreciation expense, accumulated depreciation and book value for each year. Activate Windows Go to Settings to activate Windows 150% Papel op 123 wurde L English (United States Type here to search Crocus , по Б A 10 9 2/1/2001

没有找到相关结果