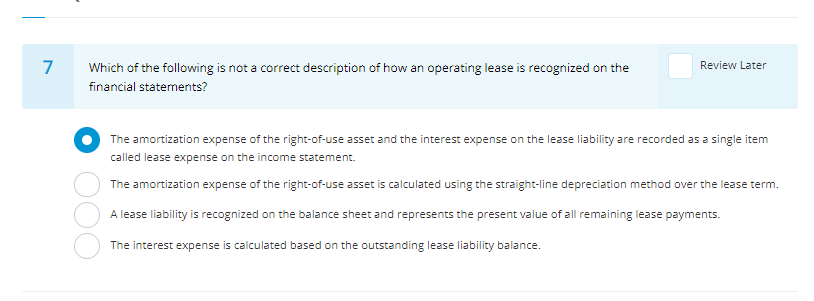

7 Review Later Which of the following is not a correct description of how an operating lease is recognized on the financial statements? The amortization expense of the right-of-use asset and the interest expense on the lease liability are recorded as a single item called lease expense on the income statement. The amortization expense of the right-of-use asset is calculated using the straight-line depreciation method over the lease term. A lease liability is recognized on the balance sheet and represents the present value of all remaining lease payments. The interest expense is calculated based on the outstanding lease liability balance.

没有找到相关结果