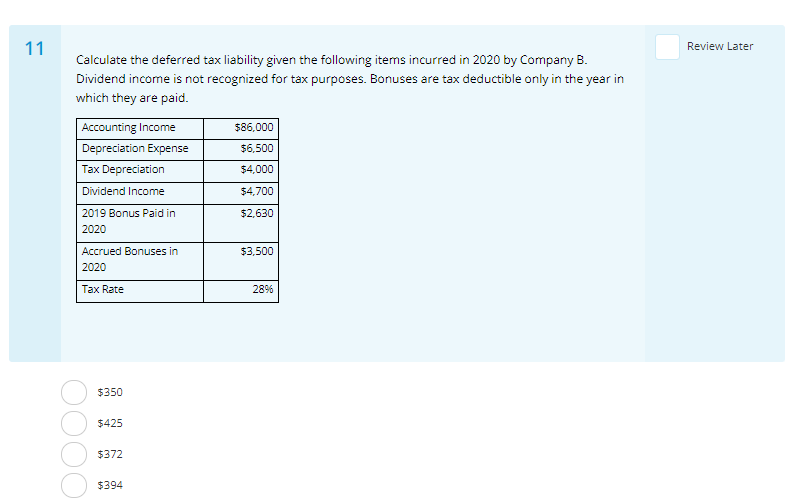

11 Review Later Calculate the deferred tax liability given the following items incurred in 2020 by Company B. Dividend income is not recognized for tax purposes. Bonuses are tax deductible only in the year in which they are paid. $86,000 $6,500 Accounting Income Depreciation Expense Tax Depreciation Dividend Income $4,000 $4,700 $2,630 2019 Bonus Paid in 2020 $3,500 Accrued Bonuses in 2020 Tax Rate 2896 $350 $425 OOOO $372 $394

没有找到相关结果