Intermediate Accounting.

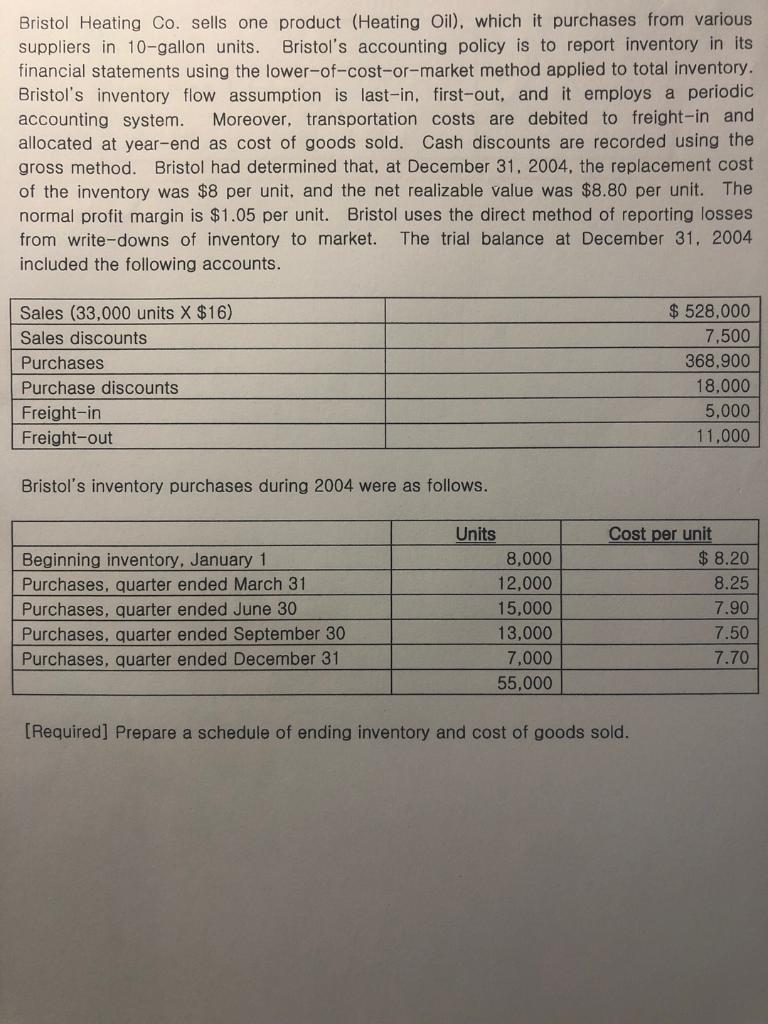

Required) Prepare a schedule of ending inventory and cost ofgoods sold.

Bristol Heating Co. sells one product (Heating Oil), which it purchases from various suppliers in 10-gallon units. Bristol's accounting policy is to report inventory in its financial statements using the lower-of-cost-or-market method applied to total inventory. Bristol's inventory flow assumption is last-in, first-out, and it employs a periodic accounting system. Moreover, transportation costs are debited to freight-in and allocated at year-end as cost of goods sold. Cash discounts are recorded using the gross method. Bristol had determined that, at December 31, 2004, the replacement cost of the inventory was $8 per unit, and the net realizable value was $8.80 per unit. The normal profit margin is $1.05 per unit. Bristol uses the direct method of reporting losses from write-downs of inventory to market. The trial balance at December 31, 2004 included the following accounts. Sales (33,000 units X $16) Sales discounts Purchases Purchase discounts Freight-in Freight-out $ 528,000 7,500 368.900 18.000 5.000 11,000 Bristol's inventory purchases during 2004 were as follows. Beginning inventory. January 1 Purchases, quarter ended March 31 Purchases, quarter ended June 30 Purchases, quarter ended September 30 Purchases, quarter ended December 31 Units 8,000 12,000 15,000 13,000 7,000 55,000 Cost per unit $ 8.20 8.25 7.90 7.50 7.70 [Required] Prepare a schedule of ending inventory and cost of goods sold.

没有找到相关结果