Tax reconciliation.

Please fill in the blankets.

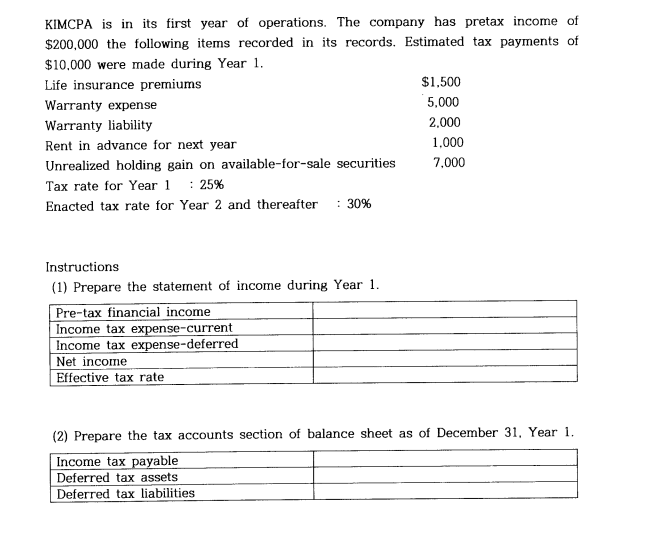

KIMCPA is in its first year of operations. The company has pretax income of $200,000 the following items recorded in its records. Estimated tax payments of $10.000 were made during Year 1. Life insurance premiums $1,500 Warranty expense 5,000 Warranty liability 2.000 Rent in advance for next year 1.000 Unrealized holding gain on available-for-sale securities 7.000 Tax rate for Year 1 : 25% Enacted tax rate for Year 2 and thereafter : 30% Instructions (1) Prepare the statement of income during Year 1. Pre-tax financial income Income tax expense-current Income tax expense-deferred Net income Effective tax rate (2) Prepare the tax accounts section of balance sheet as of December 31, Year 1. Income tax payable Deferred tax assets Deferred tax liabilities

没有找到相关结果