Describe the change, Explain the change andSuggest a cause of

Describe the change, Explain the change andSuggest a cause of

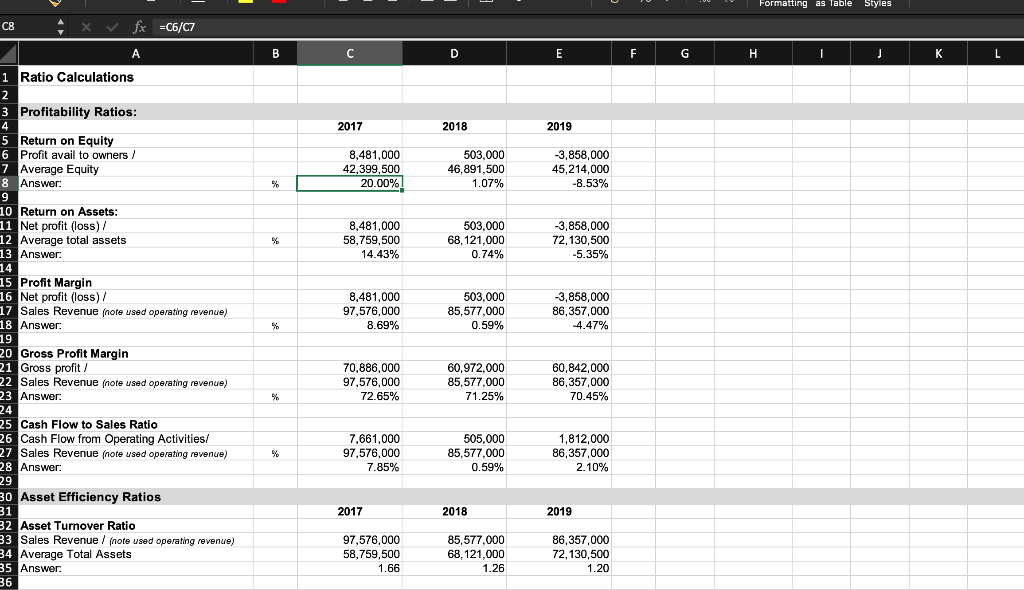

- Return on equity

- Return on assets

- Profit margin

- Asset turnover

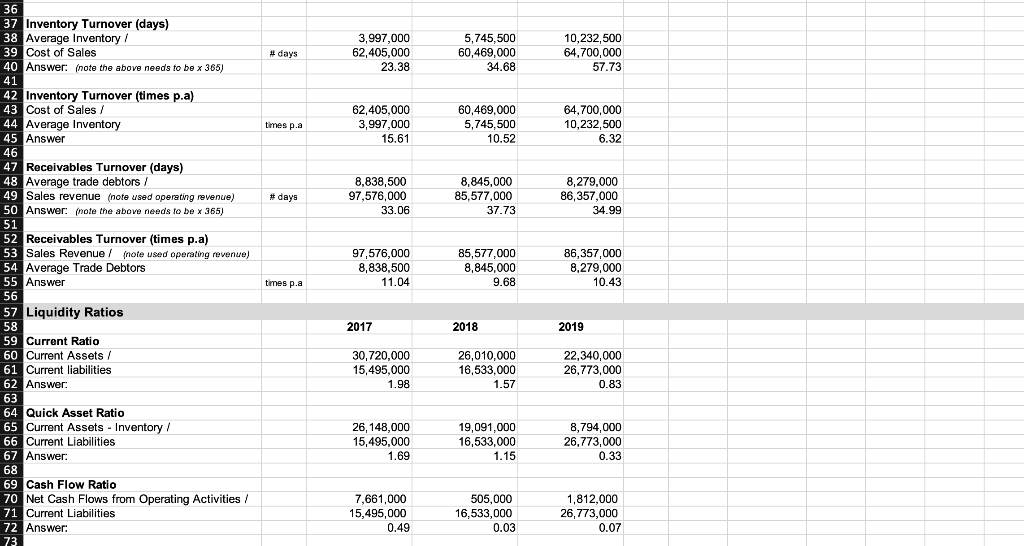

- Inventory turnover (days)

- Receivables turnover (days)

- Current Ratio

- Quick Ratio

- Cash flow (to current liabilities )

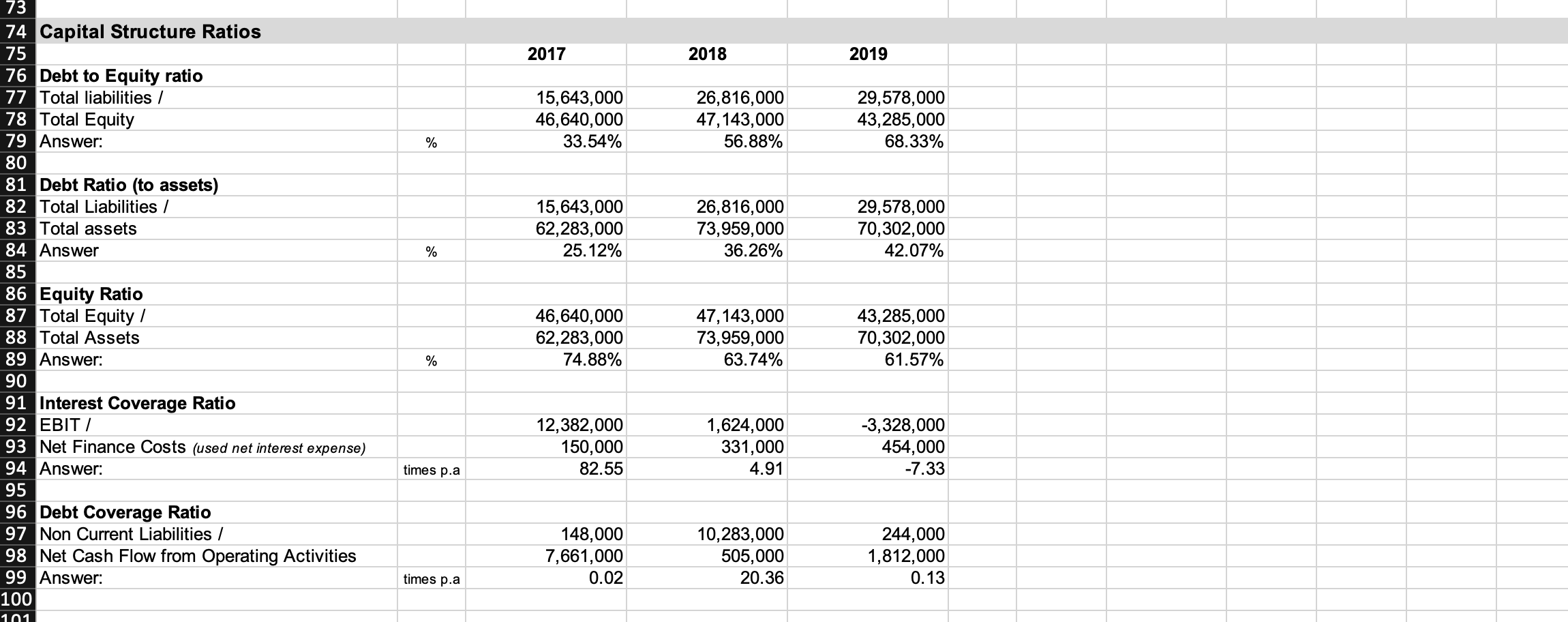

- Debt to equity

- Debt ratio

- Interest coverage

- Debt coverage

Formatting as Table Styles C8 fx =C6/07 A B с D E F G н. T J K L 2017 2018 2019 8,481,000 42,399,500 20.00% 503,000 46,891,500 1.07% -3,858,000 45,214,000 -8.53% % %. 8,481,000 58,759,500 14.43% 503,000 68,121,000 0.74% -3,858,000 72,130,500 -5.35% 1 Ratio Calculations 2 3 Profitability Ratios: 4 Return on Equity 6 Profit avail to owners/ 7 Average Equity 8 Answer: 9 10 Return on Assets: 11 Net profit (loss) / 12 Average total assets 13 Answer: 14 15 Profit Margin 16 Net profit (loss) / 17 Sales Revenue (note used operating revenue) 18 Answer: 19 20 Gross Profit Margin 21 Gross profit / 22 Sales Revenue (note used operating revenue) 23 Answer: 24 25 Cash Flow to Sales Ratio 26 Cash Flow from Operating Activities/ 27 Sales Revenue (note used operating revenue) 28 Answer: 29 30 Asset Efficiency Ratios 31 32 Asset Turnover Ratio 33 Sales Revenue / (note used operating revenue) 34 Average Total Assets 35 Answer: 36 8,481,000 97,576,000 8.69% 503,000 85,577,000 0.59% 3,858,000 86,357,000 -4.47% % 70,886,000 97,576,000 72.65% 60,972,000 85,577,000 71.25% 60,842,000 86,357,000 70.45% % %. 7,661,000 97,576,000 7.85% 505,000 85,577,000 0.59% 1,812,000 86,357,000 2.10% 2017 2018 2019 97,576,000 58,759,500 1.66 85,577,000 68,121,000 1.26 86,357,000 72,130,500 1.20

#days 3,997,000 62,405,000 23.38 5,745,500 60,469,000 34.68 10,232,500 64,700,000 57.73 times p.a 62,405,000 3,997,000 15.61 60,469,000 5,745,500 10.52 64,700,000 10,232,500 6.32 #days 8,838,500 97,576,000 33.06 8,845,000 85,577,000 37.73 8,279,000 86,357,000 34.99 36 37 Inventory Turnover (days) 38 Average Inventory / 39 Cost of Sales 40 Answer: (note the above needs to be x 365) 41 42 Inventory Turnover (times p.a) 43 Cost of Sales / 44 Average Inventory 45 Answer 46 47 Receivables Turnover (days) 48 Average trade debtors / 49 Sales revenue (note used operating revenue) 50 Answer: mote the above needs to be x 365) 51 52 Receivables Turnover (times p.a) 53 Sales Revenue / (note used operating revenue) 54 Average Trade Debtors 55 Answer 56 57 Liquidity Ratios 58 59 Current Ratio 60 Current Assets/ 61 Current liabilities 62 Answer: 63 64 Quick Asset Ratio 65 Current Assets - Inventory / 66 Current Liabilities 67 Answer: 68 69 Cash Flow Ratio 70 Net Cash Flows from Operating Activities / 71 Current Liabilities 72 Answer: 73 97,576,000 8,838,500 11.04 85,577,000 8,845,000 9.68 86,357,000 8,279,000 10.43 times p.a 2017 2018 2019 30,720,000 15,495,000 1.98 26,010,000 16,533,000 1.57 22,340,000 26,773,000 0.83 26, 148,000 15,495,000 1.69 19,091,000 16,533,000 1.15 8,794,000 26,773,000 0.33 7,661,000 15,495,000 0.49 505,000 16,533,000 0.03 1,812,000 26,773,000 0.07

2017 2018 2019 15,643,000 46,640,000 33.54% 26,816,000 47,143,000 56.88% 29,578,000 43,285,000 68.33% % 15,643,000 62,283,000 25.12% 26,816,000 73,959,000 36.26% 29,578,000 70,302,000 42.07% % 73 74 Capital Structure Ratios 75 76 Debt to Equity ratio 77 Total liabilities / 78 Total Equity 79 Answer: 80 81 Debt Ratio (to assets) 82 Total Liabilities / 83 Total assets 84 Answer 85 86 Equity Ratio 87 Total Equity / 88 Total Assets 89 Answer: 90 91 Interest Coverage Ratio 92 EBIT/ 93 Net Finance Costs (used net interest expense) 94 Answer: 95 96 Debt Coverage Ratio 97 Non Current Liabilities / 98 Net Cash Flow from Operating Activities 99 Answer: 100 46,640,000 62,283,000 74.88% 47,143,000 73,959,000 63.74% 43,285,000 70,302,000 61.57% % 12,382,000 150,000 82.55 1,624,000 331,000 4.91 -3,328,000 454,000 -7.33 times p.a 148,000 7,661,000 0.02 10,283,000 505,000 20.36 244,000 1,812,000 0.13 times p.a 101

没有找到相关结果