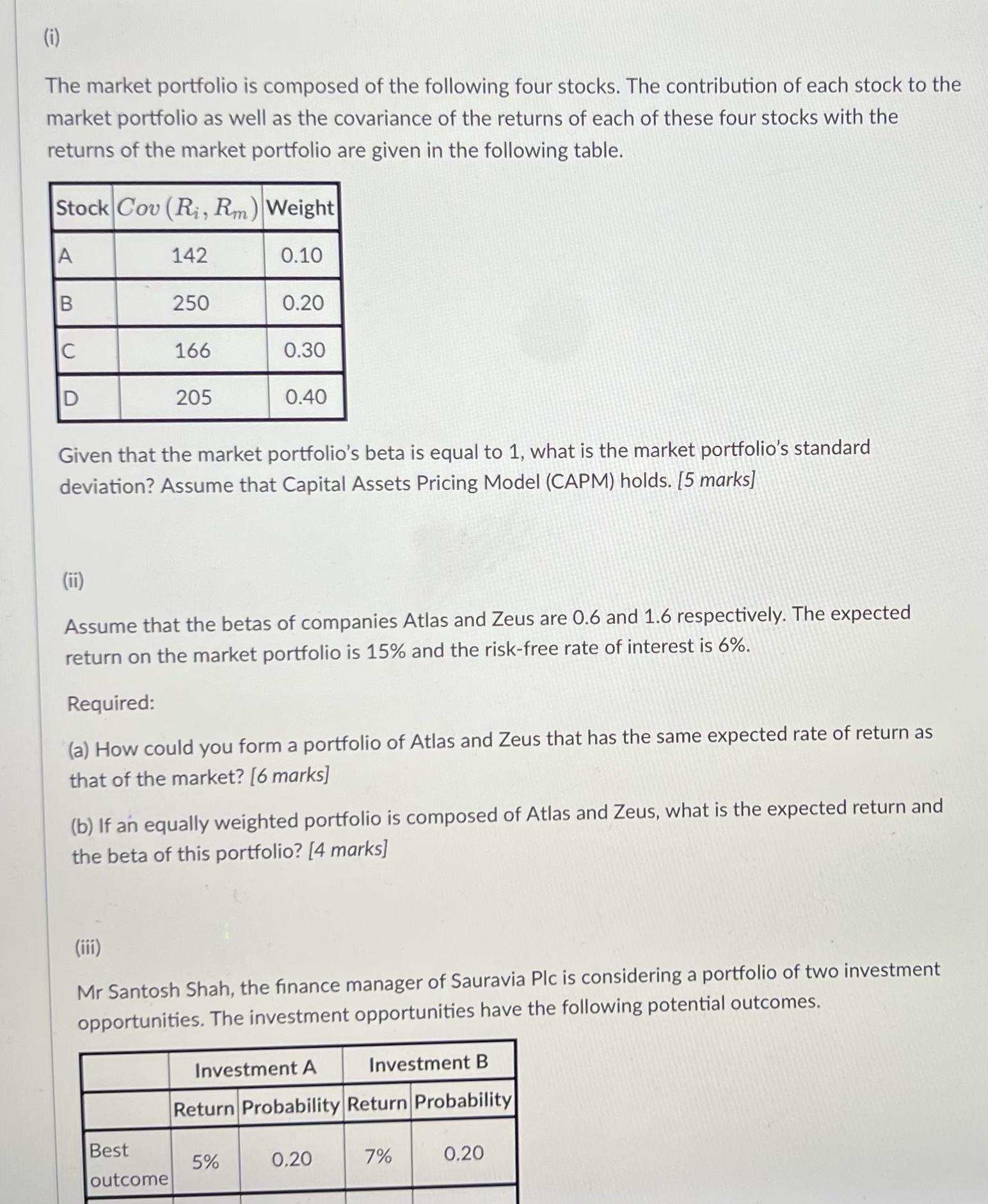

(i)The market portfolio is composed of the following four stocks.The contribution of each stock to themarket portfolio as well as the covariance of the returns of each of these four stocks with thereturns of the market portfolio are given in the following table.StockCov(Ri,Rm)WeightA1420.10B2500.20C1660.30D2050.40Given that the market portfolio's beta is equal to 1,what is the market portfolio's standarddeviation?Assume that Capital Assets Pricing Model (CAPM)holds.[5 marks]()Assume that the betas of companies Atlas and Zeus are 0.6 and 1.6 respectively.The expectedreturn on the market portfolio is 15%and the risk-free rate of interest is 6%.Required:(a)How could you form a portfolio of Atlas and Zeus that has the same expected rate of return asthat of the market?[6 marks](b)If an equally weighted portfolio is composed of Atlas and Zeus,what is the expected return andthe beta of this portfolio?[4 marks](n)Mr Santosh Shah,the finance manager of Sauravia Plc is considering a portfolio of two investmentopportunities.The investment opportunities have the following potential outcomes.Investment AInvestment BReturnProbabilityReturnProbabilityBest5%0.207%0.20outcome

没有找到相关结果