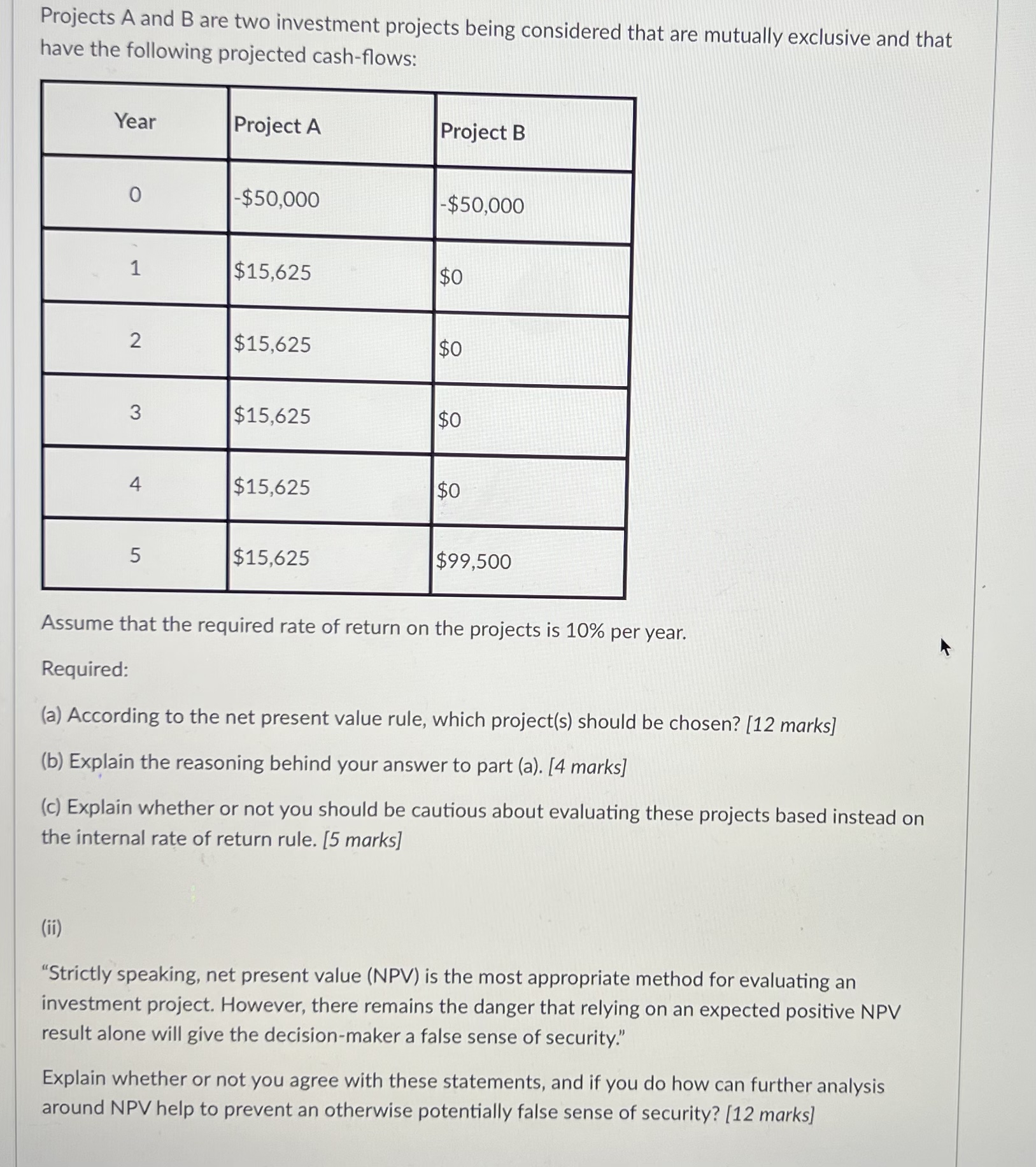

Projects A and B are two investment projects being considered that are mutually exclusive and thathave the following projected cash-flows:YearProject AProject B0-$50,000-$50,0001$15,625$02$15,625$03$15,625$04$15,625$05$15,625$99,500Assume that the required rate of return on the projects is 10%per year.Required:(a)According to the net present value rule,which project(s)should be chosen?[12 marks](b)Explain the reasoning behind your answer to part (a).[4 marks](c)Explain whether or not you should be cautious about evaluating these projects based instead onthe internal rate of return rule.[5 marks](i)“Strictly speaking,net present value(NPV)is the most appropriate method for evaluating aninvestment project.However,there remains the danger that relying on an expected positive NPVresult alone will give the decision-maker a false sense of security."Explain whether or not you agree with these statements,and if you do how can further analysisaround NPV help to prevent an otherwise potentially false sense of security?[12 marks]

没有找到相关结果